The Federal Reserve is talking about raising interest rates, but it’s also lowering growth expectations. No wonder the market’s uninspired to do much of anything at the moment. The benchmark 10-year yield was unchanged yesterday at 2.32%, based on Treasury.gov data. That’s still moderately elevated vs. the below-2% levels at various points in recent months. But the current rate is also below the 2.50% yield we saw earlier this month. For now, the upside bias is on hold.

The Fed yesterday advised that it “anticipates that it will be appropriate to raise the target range for the federal funds rate [currently at 0% to 0.25%] when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.”

But that tipping point is nowhere on the immediate horizon, or so it seems based on the Fed’s downgrade for this year’s economic outlook. The central bank pared its expected real GDP rise for the US to a 1.8%-to-2.0% range in yesterday’s revised projections, moderately below March’s outlook for a 2.3%-to-2.7% advance. Meantime, next year’s GDP growth estimate was virtually unchanged at a 2.4%-to-2.7% range. The projection for this year’s core inflation rate was left as at a 1.3%-to-1.4% range, which no one will confuse with the central bank’s 2% target. The gap is even wider if we use current projections for headline inflation. In addition, expected unemployment for 2015 ticked higher in the revised forecast data to a 5.2%-to-5.3% range.

All in all, not a lot of progress if we’re using the latest changes in the Fed forecasts as a benchmark. It’s not terrible, at least not when compared with March’s numbers, but it’s hardly the basis for labeling the prospect for rate hikes in the near term as a done deal.

Not surprisingly, Mr. Market is having second thoughts about the rate-hike scenario. Both the 10-year and the 2-year yield—considered the most sensitive spot on the yield curve for rate expectations—have pulled back from their recent highs.

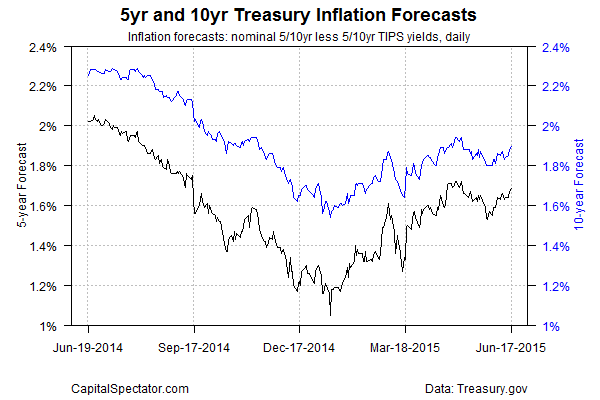

Yet the market’s inflation forecast, in contrast with the Fed’s prediction, is inching higher lately, ticking up to 1.90%, based on the yield spread for the nominal 10-year Note less its inflation-indexed counterpart. That’s just a few basis points below this year’s high point of 1.94%.

The recent upswing in market rates continues to paint a bullish tailwind in terms of moving averages. In particular, positive momentum is still conspicuous in the 2-year yield.

The rising tide is considerably less muscular for the 10-year yield, although at the moment the 50-day exponential moving average remains above its 100- and 200-day equivalents, if only just barely.

The economic data will, of course, determine if yields continue rising. But the Fed’s telling us to keep expectations in check, or so its near-term economic forecasts imply. That’s also the message in the Atlanta Fed’s current GDP nowcast for the second quarter: a sluggish 1.9% gain.

Recession risk remains low, but growth expectations are still muted. Fed Chair Janet Yellen admitted as much at one point in her press conference yesterday, explaining: “So in spite of the fact that there is some progress on that front [maximum employment] the committee wants to see some further progress before feeling that it will be appropriate to raise rates.”

Data dependency, in other words, is still the only game in town. Short of some upside surprises in the next round of macro releases, the case remains weak for anticipating that we’ll see clear signs that “progress” is just around the next bend.