When’s the last time a Nobel Prize-winning economist unwittingly made a convincing case for separating one’s political views from analyzing the business cycle and instead favoring a quantitative-based framework for estimating recession risk? Last week, actually, when Paul Krugman, in the space of two days, veered from predicting a global recession to withdrawing the warning in what might be labeled a “nevermind” moment a la Emily Litella.

Early in the morning of Nov. 9, when Donald Trump’s election victory wasn’t yet official but appeared likely, Krugman commented in a NYTimes.com post that “we are very probably looking at a global recession, with no end in sight.” Two days later, he withdrew the forecast, explaining:

There’s a temptation to predict immediate economic or foreign-policy collapse; I gave in to that temptation Tuesday night, but quickly realized that I was making the same mistake as the opponents of Brexit (which I got right). So I am retracting that call, right now. It’s at least possible that bigger budget deficits will, if anything, strengthen the economy briefly.

A few days later, he added:

Trumpism will have dire effects, but they will take time to become manifest.

In fact, don’t be surprised if economic growth actually accelerates for a couple of years.

In less than a week, one of the world’s most widely read economists veered from expecting macro collapse to seeing the possibility of stronger growth for the near future. If this macro roller coaster ride doesn’t convince you that monitoring the business cycle demands quantitative modeling, nothing will.

To be fair, Krugman was probably caught up in the drama of election night and let his emotions get the best of him. It didn’t help that US stock futures initially plunged as Trump’s election looked increasingly inevitable in the wee hours of Nov. 9. But behavioral biases, political or otherwise, are no basis for making prudent decisions about economic growth, or the lack thereof.

It’s unlikely that any one confused Krugman’s impromptu commentary with robust macro analysis, but the behavioral trap that he fell into isn’t uncommon in the dark art/science of evaluating the economic trend. More so than in other corners of the dismal science, gauging recession odds is susceptible to a wide array of biases and misguided assumptions. I’ve discussed several of these snares before, including the widespread use and abuse of cherry-picking indicators (here and here, for instance). It now seems appropriate to add political bias to the list of hazards that can (and probably will) lead us astray in the necessary task of monitoring business cycle risk.

Fortunately, there’s a better way, and it starts (and ends) with a broad sampling of the relevant data sets. It’s no less critical to keep one’s emotions in check, as Krugman’s latest episode reminds.

Regular readers of The Capital Spectator know that a proprietary model for quantifying macro risk in the US finds its way to these pages every month (here’s last month’s profile), and the results have been encouraging. But one model may not suffice, which is why I draw on the signals from other efforts, including a pair of business cycle indexes published by two regional Federal Reserve banks. (For details, see a recent sample of The US Business Cycle Risk Report here.)

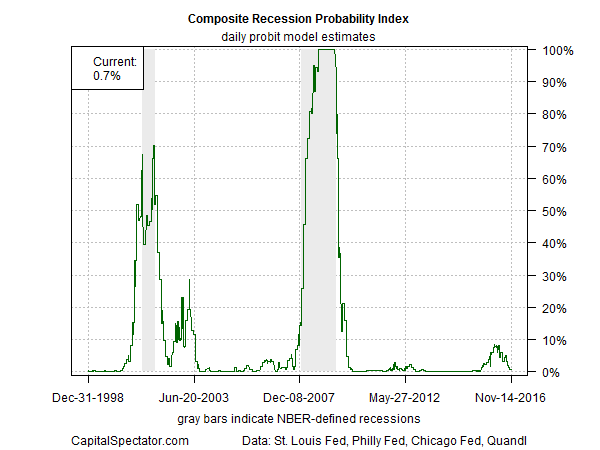

Aggregating estimates of recession probabilities via several benchmarks, each with a different methodology, can be a productive way to enhance the reliability of the signals in real time. It’s not perfect, although it’s likely that the Composite Recession Probability Index (CRPI) will be second to none for identifying the onset of the next recession in a timely manner.

The main risk for thinking otherwise: an economic bolt from the blue. Although it’s rare, a recession that strikes due to some unforeseen event can surprise even the most sophisticated modeling efforts. But downturns usually arrive through a familiar recipe of deteriorating economic conditions of one form or another, which means that monitoring the macro climate with a diversified set of indicators can identify the turning point with minimal lag. False signals abound in any one or two indicators, however, which is why the best defense is using a broad-based benchmark like CRPI.

With that in mind, here’s how CRPI currently stacks up, based on data through yesterday, Oct. 14. Nov. 14. Recession risk, according to this multi-index methodology via probit modeling, remains virtually nil at the moment—less than 1%.

That’s not written in stone for tomorrow and beyond, in part because of the elevated uncertainty that’s bound up with a Trump administration running the show in Washington. But assuming a new recession is at hand, with little or no supporting econometric facts, is the equivalent of driving blind. It may work out (if only because of dumb luck), but there’s a stronger chance that you’ll hit a wall.

Pingback: Separating Political Views from Analyzing the Business Cycle - TradingGods.net

Pingback: 11/16/16 – Wednesday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Landmark Links November 18th – Hiding in Plain Sight

Pingback: Dash of Insight| Weighing the Week Ahead: Possible Stimulus and How to Pay

Pingback: Weighing The Week Ahead: Possible Stimulus And How To Pay | 4financenews.com

Pingback: Short Week Without Much Data - TradingGods.net