Mr. Market’s cautious outlook of late is less acute at the moment relative to recent history, but it’s not obvious that all’s well. True, the US Stock Market Crash Risk Index is less threatening and a markets-based estimate of US business cycle risk has pulled back after briefly spiking higher in late-August and early September. Does that mean that it’s safe to go swimming in risky waters again? Maybe, but only for investors who: 1) can tolerate a fairly high degree of loss if they’re wrong and 2) are comfortable with a high-risk strategy of attempting to be early. For everyone else—particularly for “conservative” investors—the outlook is still sufficiently hazardous to remain cautious until a more convincing round of risk-on signals emerge.

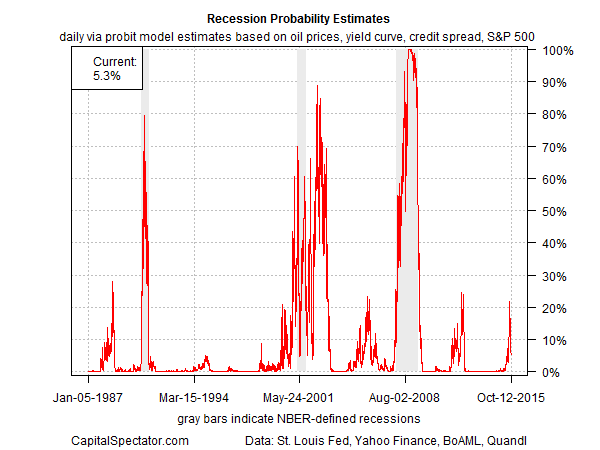

On the plus side: a markets-based estimate of US recession risk has eased recently. After spiking to more than 20% in August for estimating recession-risk probability for the US, this probit model-based estimate of macro trouble has pulled back to around 5% as of yesterday (Oct. 12). Even at the height of the August surge, this measure of economic risk never moved beyond the tipping point of roughly 50%. The message: risk is elevated, but it’s not yet obvious that a recession is fate. No wonder, then, that the economic numbers proper align with that view, based on last month’s profile of the macro trend.

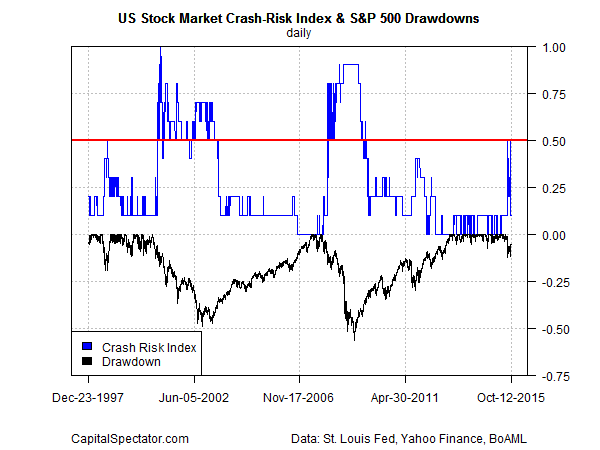

Meanwhile, the US Stock Market Crash Risk Index is less threatening at the moment. Of the ten components that comprise this benchmark, only one is flashing a warning—the Hidden Markov model (HMM) that’s telling us that US equity trend (S&P 500) is in a bear market—a regime shift that started on Aug. 26 and remains in effect, according to this indicator.

Here’s a closer look at the Crash Risk data. Note that the S&P drawdown has eased lately (black line in chart below), which offers a degree of comfort for thinking that the market’s correction isn’t moving into the land of no return, at least based on numbers through yesterday (Oct. 13).

The fact that only one out of ten of the Crash Risk Index metrics are in the red zone is encouraging. But the question boils down to how much faith should we put in the HMM data? As I discussed previously, HMM’s real-time record in signaling the start of the 2008-2009 bear market was timely and accurate. That doesn’t mean that HMM is right this time. But until we see this indicator pull back from its bearish stance, a cautious outlook for the US stock market is recommended.

The bottom line: macro and market risk are elevated relative to the calm waters that prevailed prior to August. The key factor that’s keeping optimism alive these days, at least from a US perspective: the absence of a clear signal that the US economy has slipped over to the dark side. Growth has clearly slowed–in the US and around the world generally. But based on the US hard data through September (and market figures through Oct. 12), there’s still a decent case for arguing that the US macro trend will remain positive.

If the slower rate of growth gives way, however, the last line of defense for the optimists will evaporate. The still-uncertain October macro profile for the US, in other words, may be decisive. For the moment, cautious optimism prevails. The main event is watching how or if the incoming economic data alters what we think we know today.