Prices continued to rise last week in most markets around the world, based on a set of ETFs representing the major asset classes. Leading the winners during the five trading days through Feb. 3: emerging-market bonds. The only losers last week: inflation-indexed US Treasuries and broadly defined commodities.

VanEck Vectors JP Morgan Emerging Market Local Currency Bond (EMLC) topped the leaders list last week with a 1.9% total return. The robust gain marks the seventh straight weekly advance for the ETF.

The iPath Bloomberg Commodity (DJP) posted the biggest loss last week, easing 0.2%. The latest dip is the third consecutive weekly setback for the ETN.

The generally rising tide dispensed another gain for an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights climbed 0.4% last week. The benchmark has enjoyed positive weekly returns in four of the first five weeks to date in 2017.

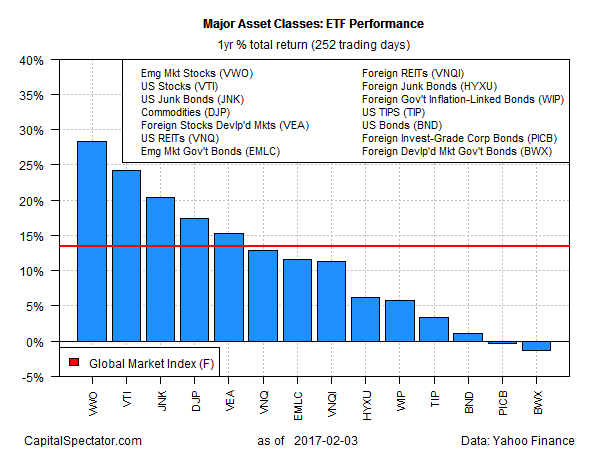

In the one-year column, emerging-market equities continue to hold the lead. Vanguard FTSE Emerging Markets (VWO) is up a strong 29.2% for the 12 months through Feb. 3. In fact, VWO has been the top performer for the trailing one-year window in every weekly update so far this year.

The biggest one-year loser at the moment: foreign government bonds in developed markets. BWX is off 0.7% for the 12 months through Friday.

Meanwhile, GMI.F’s one-year trend remains encouraging, posting a 13.5% total return through Feb. 3.

For some perspective on what to expect from the major asset classes in the long run, here’s the current update for risk premia projections.