The falling US stock market paints a worrisome outlook, but the latest nowcasts for US GDP in the fourth quarter continue to project a softer-but-still healthy pace of economic activity, based on estimates compiled by The Capital Spectator.

The median Q4 nowcast via these estimates is 2.7% (seasonally adjusted annual rate), marking a fractional increase from the previous estimate on Dec. 6. Although today’s median marks a downshift from Q3’s 3.5% rise and Q2’s stellar 4.2% surge, the current outlook continues to suggest that recession risk for the US remains low for the immediate future.

There are, however, several risk factors lurking that are weighing on sentiment, ranging from the threat of a government shutdown at the end of the week to signs that the global economy is slowing. These headwinds, along with other issues – the unresolved trade war between the US and China, for example – may take a bigger bite out of GDP expectations in the weeks ahead.

A wobbly housing market isn’t helping. For example, the Housing Market Index, a measure of confidence in the home building industry, slumped to a 3-1/2 year low this month. That’s a clue for thinking that housing construction and related activity will remain sluggish in the near term. Indeed, today’s update on housing starts for November is expected to post a second straight monthly decline, according to Econoday.com’s consensus forecast.

Nonetheless, there’s still a case for anticipating a respectable if moderately slower US expansion in the final three months of 2018.

“Athough growth remains relatively robust, momentum is being lost and is likely to continue to fade as we move into 2019,” said Chris Williamson, chief business economist at IHS Markit, in last week’s release of business-survey data for December.

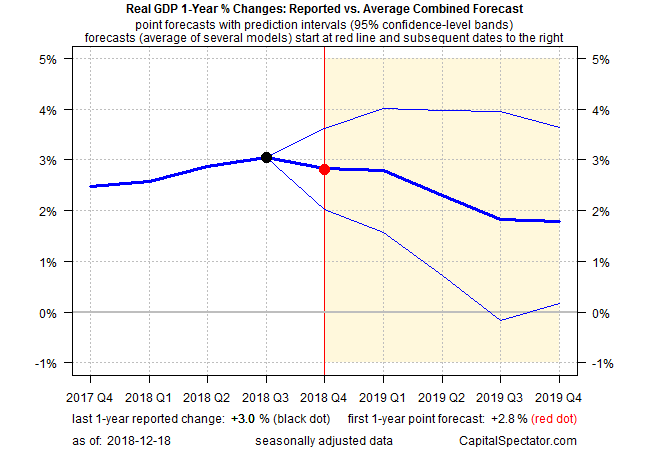

A weaker macro trend next year is also the outlook for GDP in terms of projected year-over-year changes. The chart below shows estimates for one-year GDP comparisons, based on the average forecast of eight models (including ARIMA, VAR and neural net applications) calculated by The Capital Spectator. The outlook anticipates that the 3.0% annual increase in real GDP in the third quarter will edge down to 2.8% in Q4 and slip further in 2019.

Softer growth doesn’t necessarily mean that a new recession is lurking in the new year, although the crowd is increasingly worried about the risk.

“Globally the world is slowing down, we just haven’t slowed down as much,” United Services Automobile Association’s Wasif Latif told CNBC yesterday. “So there’s a risk that we slow down as well.”

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report