The prospect of more interest-rate increases in the absence of rising inflation, based on the Federal Reserve’s latest forecast, strikes some as unnecessarily risky for the economy. But for good or ill, the central bank remains on track to lift rates further and the Treasury market (still) expects no less after the 25-basis-point increase from earlier in the week that pushed the Fed funds target rate to a 2.0%-2.25% range, the highest in more than a decade.

Using the Fed’s revised forecasts as a guide (published on Wed., Sep. 26), the outlook for US inflation remains tame at roughly 2.0%, which matches the bank’s target. The personal consumption expenditures (PCE) price index excluding the volatile food and energy components is projected to increase 2.0% this year, unchanged from the June estimate. So-called core inflation will tick up to 2.1% in 2019, the Fed predicts, but that’s also identical to previous outlook.

Is an upside inflation surprise likely for the near term? “We don’t see that,” Fed Chairman Powell said in a press conference on Wednesday. “It’s not in our forecasts.”

A New Book On Using R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

What, then, is convincing the central bank to keep rates on an upward trajectory? Solid economic growth that’s expected to persist. In fact, a plan to gradually raise interest rates “is helping to sustain this strong economy,” he said in a speech yesterday. He added that “there’s no reason to think that the probability of a recession in the next year or two is at all elevated.”

Never mind that trying to estimate recession risk two years out is virtually impossible. Regardless, the main takeaway from Powell’s latest comments: the Fed is confident that inflation will remain contained at or near its 2.0% target while economic growth will remain healthy.

Recent economic estimates certainly offer no reason to doubt the rosy outlook, as several examples from this week’s macro updates suggest:

- GDP Growth: the revised estimate of second-quarter growth reflected a strong 4.2% increase.

- Headline orders for new durable goods in August accelerated to an 11.2% year-over-year pace, the fastest rate in more than a year.

- New filings for unemployment benefits remain close to the lowest level in nearly five decades.

Meanwhile, the outlook for third-quarter GDP remains upbeat. The Atlanta Fed’s GDPNow model, for example, sees output rising 3.8% in Q3, according to yesterday’s update. Now-casting.com’s estimate for Q3 is softer but still points to a solid a 3.4% rise, according to today’s release.

Not surprisingly, the Treasury market anticipates that rates will continue to trend higher, which more or less reflects and extends the bias in recent history. The policy sensitive 2-year yield has been trading at 2.83% in recent days, the highest in nearly 11 years.

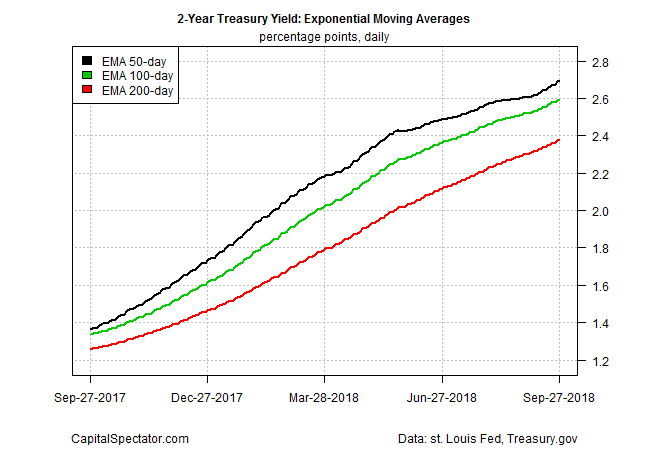

A set of exponential moving averages (EMAs) imply that upside momentum is strong for the 2-year rate, which appears set to climb further.

The benchmark 10-year rate’s technical profile isn’t as bullish, but an upside bias is still conspicuous.

The Fed’s expectations for inflation and economic growth are subject to all the usual caveats, of course, but until or if the economic reports tells us otherwise it’s reasonable to expect that Treasury yields will continue to drift higher.

Fed Chair Powell, in fact, emphasized that the key to guidance on monetary policy from here on out is all about the drip, drip, drip of newly minted macro updates from day to day (as opposed to the Fed’s forecasts). “We don’t want to suggest either that we have this precise understanding of where accommodative [monetary policy] stops or suggest that’s a really important point in our thinking,” he said this week. “What we’re going to be doing … is carefully monitoring incoming data.”

Pingback: More Interest Rate Increases? - TradingGods.net