It’s widely recognized that the manufacturing sector is highly sensitive to the business cycle. Employment trends in this corner tend to react earlier to macro distress compared with payrolls generally. As a result, monitoring this slice of the labor market offers a valuable benchmark for evaluating the macro trend. The good news is that these numbers point to economic growth for the foreseeable future.

For the year through March, manufacturing employment increased 0.6%. Although that’s a modest rise by historical standards in the last several years, it’s up from the recent low of last July, when the year-over-year trend in this sector was essentially flat. At the time, the deterioration in the pace of growth looked troubling, but the annual data never slipped into negative territory. The fact that growth in manufacturing employment has picked up in the months since last summer suggests that economic activity has also improved.

You can find support for this upbeat analysis in recent business surveys, including Markit’s PMI manufacturing data. “Strong output and new business growth continues in March,” Markit advised in last month’s update. Today’s flash estimate for April is expected to offer a similar message, according to the consensus forecast via Econoday.com.

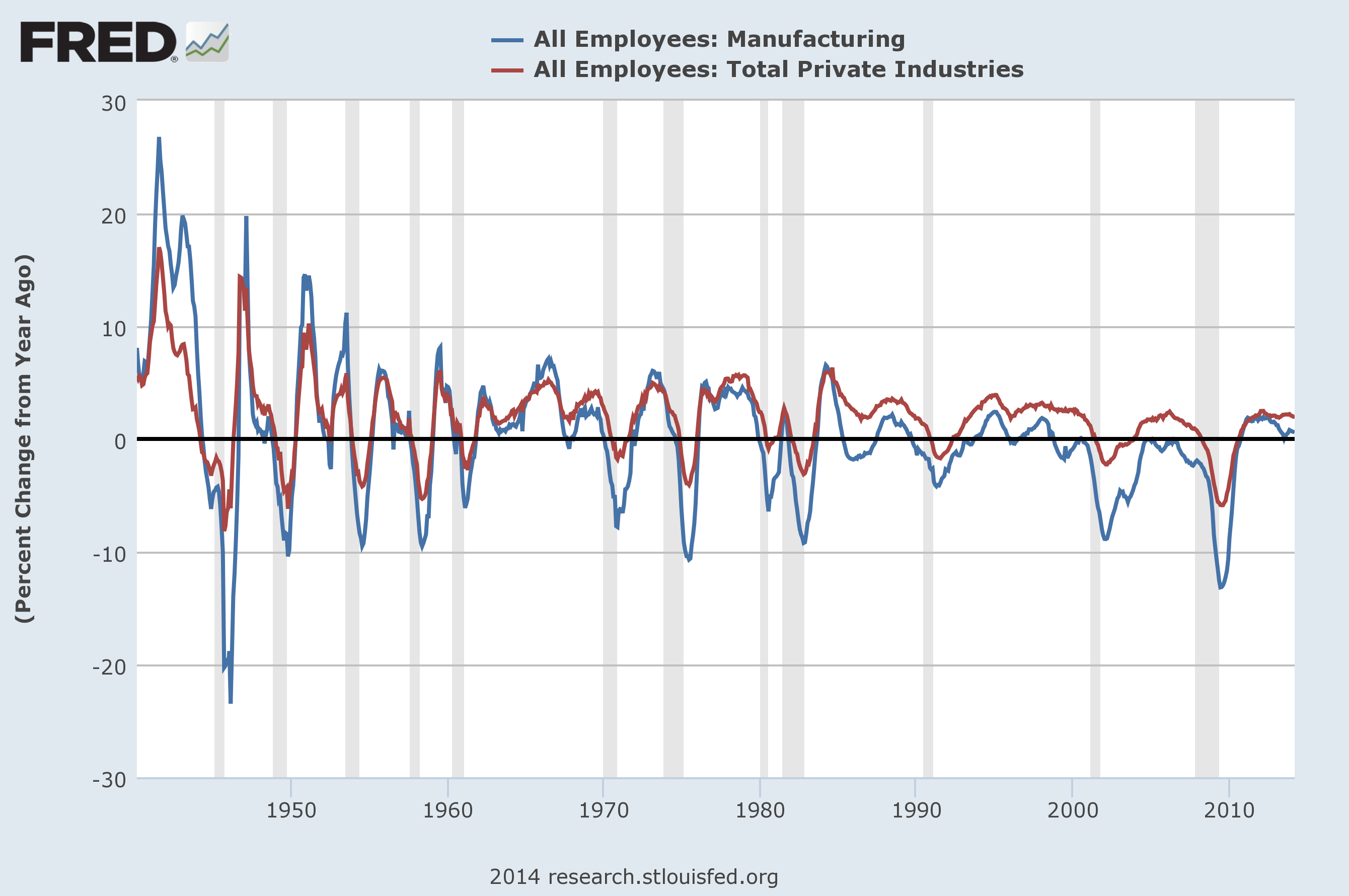

Looking at manufacturing’s record across the decades strengthens the case for seeing this slice of the labor market as an early warning sign of trouble when the state of macro turns wobbly. As the next chart shows, the year-over-year change in manufacturing payrolls (blue line) in the post-World War II era tends to exhibit deterioration in advance of the national figures for payrolls (red line).

As usual, however, perfection is elusive. The downside of looking at a cyclical indicator that’s highly sensitive to economic conditions: elevated volatility in the data. In turn, that raises the potential for a higher number of false signals when looking for early signs of heightened recession risk. That’s certainly true when we look at the record for manufacturing employment. Sometimes distress in this sector carries no broader message for the national economy. The challenge is recognizing when there are national implications. What’s the solution? Look to a broad set of indicators for deeper context.

By that standard, the recent improvement in the pace of employment growth in manufacturing seems to signal progress for economic growth generally (see last week’s US Economic Profile update for details). That’s also the view according to this week’s update of the Conference Board’s Leading Economic Index, which rose “sharply again” in March, delivering its third monthly increase, an economist at the consultancy noted in a press release. “After a winter pause, the leading indicators are gaining momentum and economic growth is gaining traction,” said Ataman Ozyildirim.

The positive trend is subject to change, of course, but for the moment the data looks encouraging in the delicate art of anticipating the future. When and if there’s cause for an attitude adjustment, we’re likely to see an early clue in manufacturing employment.