There’s a lot riding on tomorrow’s US consumer inflation report for December for markets, which are pricing in relatively upbeat news. Quite a lot of the stock market’s upbeat profile recently is closely linked to forecasts that the worst has passed for inflation, which leaves room for the Federal Reserve to start cutting interest rates. In that case, the market has a green light to reprice equity prices up, which it’s been doing in no trivial degree in recent months. Meanwhile, US Treasury yields have fallen recently, largely for the same reason. Tomorrow’s CPI report will provide a reality check on the rosy assumptions of late.

Economists expect a bit of a mixed bag. For the year-over-year headline data, consumer inflation is projected to tick up to 3.2% from 3.1% in November, based on Econoday.com’s consensus point forecast. That’s still well below the recent trend, but the Fed’s 2% inflation target appears set to remain elusive for the immediate horizon.

The sticky headline data will be offset by expectations for softer core CPI reading, which strips out food and energy in a bid to estimate a more reliable measure of the trend. This estimate of pricing pressure is on track to ease to 3.8% year-over-year in December. If correct, this crucial measure of inflation will dip below 4% for the first time in nearly three years.

Nonetheless, Vanguard’s senior international economist reminds that “Prices continue to fall at a rapid clip” vs. the start of 2023, but Andrew Patterson doesn’t expect that the Fed’s 2% target will arrive until late this year at the earliest.

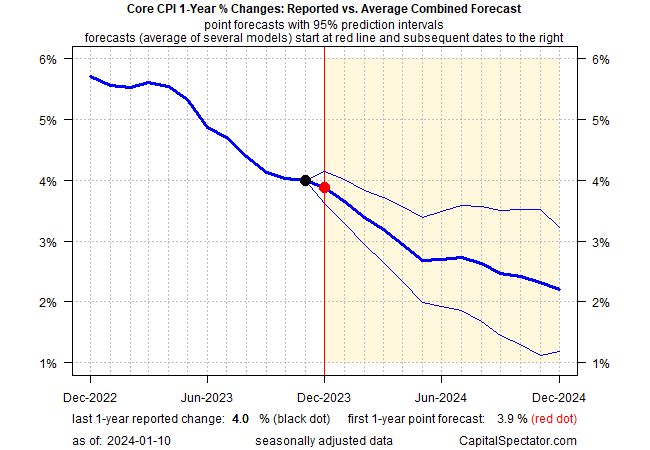

Patterson’s outlook aligns with CapitalSpectator.com’s econometric forecast for core CPI, based on a proprietary ensemble model. By the end of 2024, this estimate of year-over-year inflation is projected to slide to just over 2%, based on the point forecast.

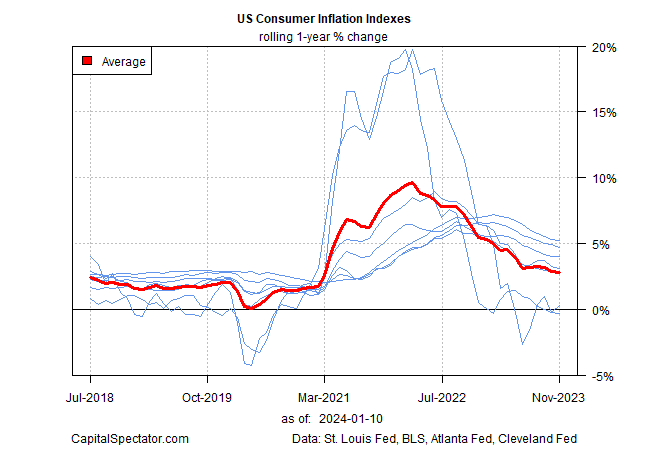

The case for expecting ongoing disinflation also looks persuasive via a set of alternative measures of pricing pressure (for a list, see p. 3 of this sample issue of The US Inflation Trend Chartbook, a companion newsletter for subscribers to The US Business Cycle Risk Report). In the chart below, the sliding trend remains intact and looks set to persist for the near term.

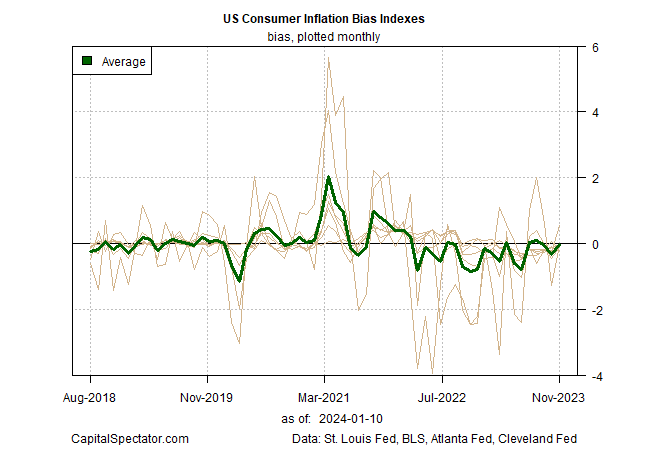

For another perspective, consider how the bias compares in the chart above. In the next chart below, there’s a clear downside bias for the monthly changes in the year-over-year data points.

Although the numbers suggest more progress lies ahead in the battle to tame inflation, the potential for upside surprises can never be ruled out, particularly in the short term. But looking through the noise that could muddy the waters for any given month, the disinflation trend remains on track, even if that’s not always obvious for any one CPI update.

“On balance, we look for this week’s CPI report to show that inflation continues to slow on trend in a way that positions the FOMC to start cutting rates in June,” writes Sam Bullard, managing director and chief economist for Wells Fargo’s corporate and investment banking group.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report