September was a rough month for the major asset classes: Every slice of global markets fell. The only exception: cash. Otherwise, the primary market betas lost ground across the board, marking the first full sweep of declines since March.

The S&P US T-Bill 0-3 Month Index, a cash proxy, offered a thin antidote to the selling by ticking up one basis point last month. For the rest of the field varying shades of red prevailed.

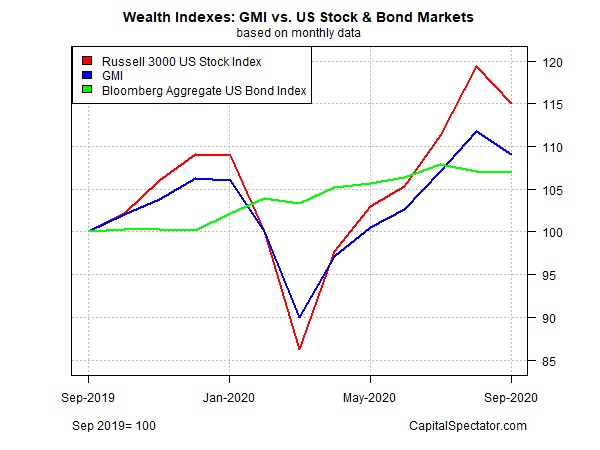

The deepest cut: US stocks via the Russell 3000 Index, which retreated 3.6% in September – the first monthly drop for this broad-based benchmark since March’s 13.8% collapse.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Broadly defined commodities, along with US real estate investment trusts and foreign high-yield bonds were the runners-up for losses in September, shedding between 3.0% and 3.4%.

The Global Market Index (GMI) didn’t escape last month’s broad retreat. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, lost 2.4% in September, the first decline since March’s unusually steep 10.1% crash.

For the trailing one-year window, GMI is still posting a solid 9.0% gain. That’s a middling result compared with the 15.0% one-year total return for US stocks (Russell 3000) and the US investment-grade bond market’s 7.0% gain, based on the Bloomberg US Aggregate Bond Index.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Performance Review for Major Asset Classes - TradingGods.net

Pingback: Commodities Topped Last Week's Wide-Ranging Gains - TradingGods.net

Pingback: Global Markets Led by US Stocks and Bonds - TradingGods.net

Pingback: Desperately Seeking Yield | Investing.com - Trading Sorority

Pingback: Junk Bonds and Emerging Markets Led Returns Last Week - TradingGods.net