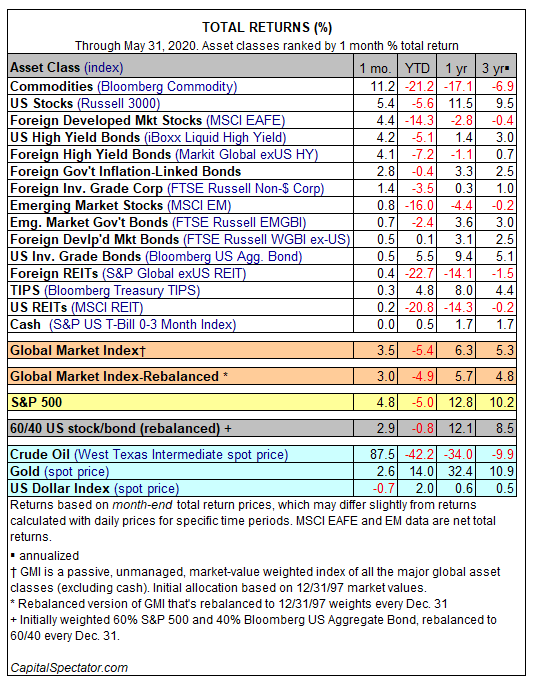

Asset prices continued to rebound in May, building on April’s widespread gains. Commodities joined the party this time by leading the across-the-board celebration in global markets last month.

Bloomberg Commodity Index surged 11.1% in May — the benchmark’s biggest monthly increase in a decade. Crude oil was the main driver with a dramatic 87.5% rise after a hefty decline over the previous two months.

US stocks were in second place in May, albeit distantly with a 5.4% gain via the Russell 3000 Index. The solid advance marks the second monthly increase following back-to-back losses for American equities in the first three months of the year.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Every corner of the major asset classes rose in May, but thanks to the revival of a risk-on climate the weakest performance last month was cash. The S&P US T-Bill 0-3 Month Index ticked higher, just barely, with a 0.01% gain.

For the year to date, however, losses still prevail. The only exceptions: US and foreign investment-grade bonds, inflation-linked Treasuries and cash.

The Global Markets Index (GMI) posted a second straight monthly gain in May. GMI, an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights, rose 3.5%. For the year so far, however, GMI remains underwater by 5.4%, courtesy of steep losses in the first quarter that continue to linger.

For the trailing one-year window, the trend looks brighter for GMI, which is up 6.3%. US investment-grade bonds earned even more over the last 12 months and US stocks (Russell 3000) are higher by nearly 12% vs. the year-ago level after including dividends.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Property Shares Led Returns Last Week - TradingGods.net

Pingback: Commodities and US Shares Posted the Highest Gains for Last Week - TradingGods.net