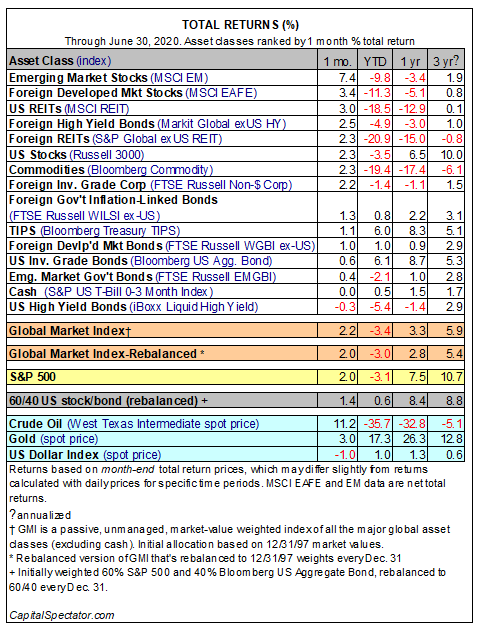

Emerging-market equities rose sharply in June, posting the strongest gain for the major asset classes last month. Overall, higher prices prevailed in risk assets. The lone exception: a mild dip for high-yield bonds in the US.

Stocks in emerging markets were the clear winner in June. The MSCI Emerging Markets Index jumped 7.4%, marking the third straight monthly gain. Although this corner of the global stocks is still underwater for the year, shares in emerging markets have recovered a substantial portion of deep loss in the first three months of 2020.

US stocks also continued to rise last month. The Russell 3000 Index posted a 2.3% gain—the third consecutive monthly advance, which trimmed the year-to-date loss to a modest 3.5% slide.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

US junk bonds were the only loser in June. The iBoxx Liquid High Yield Index ticked down 0.3%–the first monthly setback since March’s dramatic 10.3% decline.

Despite the broad upswing last month, red ink still prevails for the year-to-date results. The deepest loss so far this year: foreign real estate shares. The S&P Global ex-US REIT/Real Estate Index is down a hefty 20.9% in 2020 through June 30.

The Global Market Index continues to rebound after the sharp loss in the first quarter. This unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights, rose 2.2% in June, the third straight monthly increase. Year to date, however, GMI is off 3.4%.

For the trailing one-year window, recovery from the Q1 correction endured. GMI is up a modest 3.3% vs. the year-ago level, although this 12-month advance trails the one-year increases for a broad measure of US investment-grade bonds (Bloomberg S Aggregate Bond) and US stocks (Russell 3000).

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Emerging-Market Equities Rose in June - TradingGods.net

Pingback: Real Estate Investment Trusts Posted Strong Gains Last Week - TradingGods.net

Pingback: Emerging Markets Posted Strongest Gain Last Week - TradingGods.net

Pingback: Government Bonds Surged Last Week - TradingGods.net