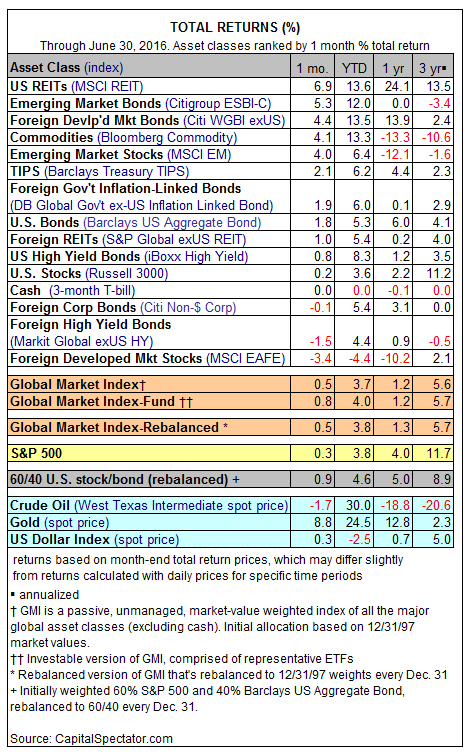

June delivered a solid month of gains for most of the major asset classes. Although the Brexit vote late last month took markets on a roller coaster ride, when the dust cleared on June 30 the trend was heavily skewed to the positive column.

The big winner last month: US real estate investment trusts (REITS). The MSCI REIT Index surged 6.9%, in part because mixed US economic data and Brexit worries imply that the Federal Reserve will keep interest rates lower for longer. In turn, that’s good news for relatively high-yielding REITs, which remain in high demand in a world that’s desperate for an attractive and comparatively reliable payout.

June’s big loser: stocks in developed markets in US dollar terms. The MSCI EAFE Index stumbled 3.4% last month. For the trailing one-year period, EAFE is off more than 10%, one of the worst performances over the last 12 months for the major asset classes.

The negative drag from EAFE weighed on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. EAFE’s current weight in GMI is around 20%, the third-highest after US stocks and US bonds. Despite EAFE’s headwind, GMI managed to post another monthly gain in June: a fractional 0.5% increase—the index’s fifth consecutive monthly advance.

The latest rise in GMI lifted the index’s 3-year trailing rise to an annualized 5.6%, a seven-month high. The firmer performance in June marks another month of recovery after GMI’s 3-year return dipped to 3.2% in January, the lowest in five years. Note that the recovery accompanies a similar turnaround in the long-run risk premia forecasts for GMI in recent months (see last month’s update, for example).

It’s unclear if the U-turn in current and projected returns for GMI signal a sustainable recovery. But on an encouraging note, GMI’s realized performance continues to exceed the expected return. For the moment, at least, there’s a positive tailwind blowing.

The question is whether the incoming economic data will corroborate the market’s profile upgrade of late. The main event on that front is this week’s June employment report. Economists are betting that May’s dramatic slowdown in growth was a one-time event. Econoday.com’s consensus forecast sees headline job growth rebounding sharply in June, rising 180,000 vs. just 38,000 in the previous month. If the crowd turns out to be wrong, GMI’s recovery may hit a wall.

Pingback: Major Asset Classes Gain in June - TradingGods.net

Pingback: Of poetic bankers | Disruptive Markets

Pingback: Tuesday Morning Links | timiacono.com

Pingback: Solid Return Posted by SPDR Barclays High Yield Bond - TradingGods.net

Pingback: Emerging Market Equities Led Global Stock Markets Last Week - TradingGods.net