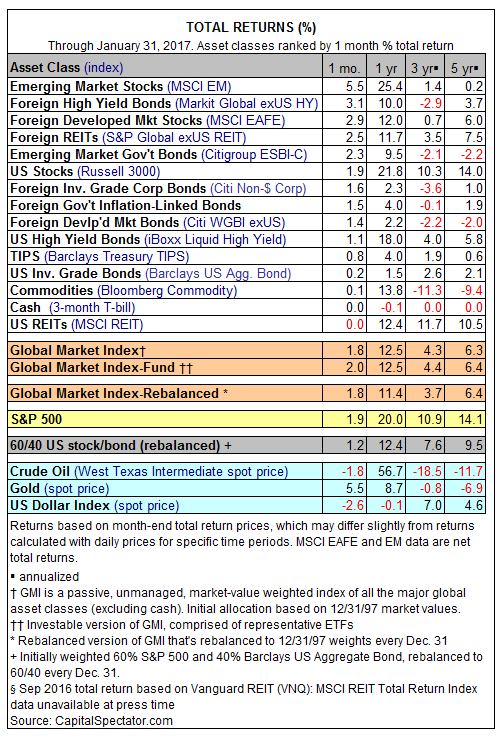

Most markets around the world continued to rise in 2017’s opening month, building on last year’s broadly positive close. Leading the way higher in January: emerging-market stocks (MSCI EM), with foreign high-yield bonds in second place (Markit Global ex-US High Yield). Last month’s bottom performer: US real estate investment trusts via MSCI US REIT, which is unchanged so far this year.

MSCI EM’s 5.5% total return in January (the best monthly gain in nearly a year) lifted the index to top the one-year performance column for the major asset classes. Meanwhile, MSCI US REIT’s flat performance marks the fifth time in the last six months that the index fell or was unchanged on a total-return basis.

US stocks earned a moderate 1.9% gain in January (Russell 3000), posting a third straight monthly advance. For the trailing one-year period, US equities are ahead by nearly 22%, second only to emerging-market stocks for this time window.

Last month’s bullish tailwind provided another boost to the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI added 1.8% last month, raising the index’s one-year total return through January to a strong 12.5%.

Pingback: How Major Asset Classes Performed In January | The Baltics and Beyond

Pingback: 02/02/17 – Thursday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Commodities Win Last Week - TradingGods.net

Pingback: US Stocks Rallied Last Week As Commodities Slumped – Investing.com – Tradersville

Pingback: REITs Rebound And Commodities Slump - PakiMania

Pingback: REITs Rebound And Commodities Slump - TradingGods.net