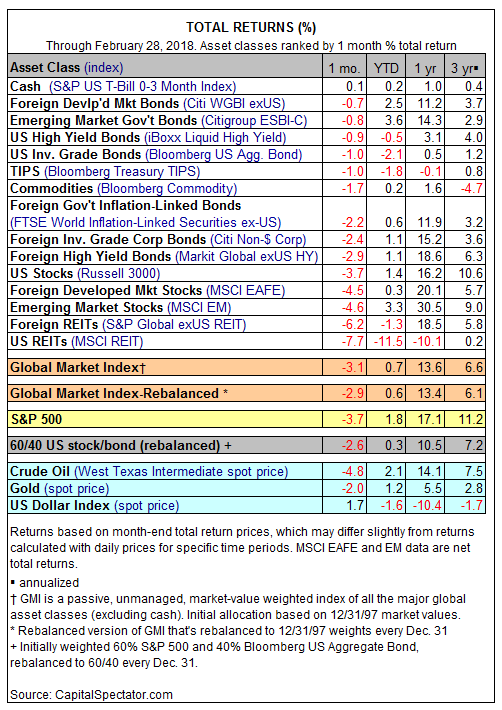

The winning streak hit a wall in February. For more than a year, global markets have been trending higher, in some cases with an unbroken run of monthly gains. But the party came to a full stop last month. For the first time in more than two years, all the major asset classes posted losses for the calendar month (except for cash, based on the S&P US T-Bill 0-3 Month Index, which edged up in February).

US real estate investment trusts (REITs) suffered the biggest setback. The MSCI REIT Index tumbled a hefty 7.7% — the third straight decline and the deepest monthly slide in over six years.

The smallest loss in February was posted by foreign government bonds in developed markets. The Citi World Government Bond Index ex-US shed a relatively light 0.7%. The decline marks the first round of monthly red ink for the index since October.

When will the next recession strike? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

The US stock market was among last month’s casualties, although the stumble on this front is middling in context with the range of losses for the major asset classes. Nonetheless, the 3.7% drop for the Russell 3000 is notable as the first monthly decline for the index since Oct. 2016.

Not surprisingly, last month’s selling wave dented the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. After an extraordinary 14-month run of unbroken gains, GMI’s momentum came to a halt in February with a 3.1% decline, the deepest monthly loss for the benchmark in two years.

Pingback: Major Asset Classes Ended in the Red - TradingGods.net

Pingback: US REITs Continued To Rebound Last Week - TradingGods.net