The Global Market Index’s risk-adjusted performance continued to roar higher through the end of 2021, based on the trailing 3-year Sharpe ratio, a measure of return adjusted by volatility. GMI started looking a bit subdued in November, thanks to widespread selling. But the strong rebound for risk assets in December fired up risk-adjusted results for GMI, an unmanaged, market-value-weighted portfolio that holds all the major asset classes (except cash).

GMI’s 3-year Sharpe ratio surged to 1.29 in December, the highest level in more than four years (black line in chart below). The slower moving trailing 10-year Sharpe ratio, by contrast, was relatively steady, inching up to 0.99 last month (red line), the highest since April 2019.

History suggests that upward spikes in GMI’s Sharpe ratio are quickly reversed, which implies that choppy market activity lies ahead. There’s no guarantee, of course. Indeed, skeptics of reading market history’s tea leaves for guidance are quick to note that much of what appeared reasonable for market activity in recent years has been trashed amid a mostly non-stop bull market.

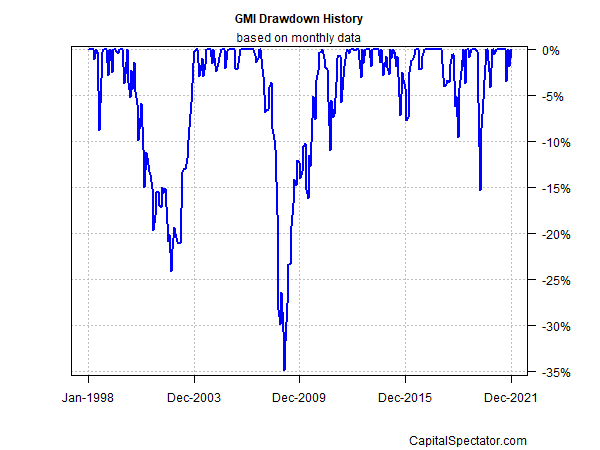

Using drawdown to profile GMI’s risk certainly suggests a benign climate prevails. GMI closed at a record high 2021’s end, which translates to a zero peak-to-trough decline. That low-risk profile is in keeping with recent history: GMI’s drawdowns have been relatively mild for well over a year, ranging from zero to roughly -3.5% at most.

GMI represents a theoretical benchmark for the “optimal” portfolio. Using standard finance theory as a guide, this portfolio is considered a preferred strategy for the average investor with an infinite time horizon. Those assumptions are, of course, unrealistic in the real world. Nonetheless, GMI is useful as a baseline to begin research on asset allocation and portfolio design. GMI’s history suggests that this benchmark’s performance is competitive with active asset-allocation strategies overall, especially after adjusting for risk, trading costs and taxes.

For additional perspective, readers can use the risk profile for GMI alongside the current monthly updates on performance and expected return for the benchmark and its components. In addition, total return forecasts are updated monthly via three models at The ETF Portfolio Strategist.

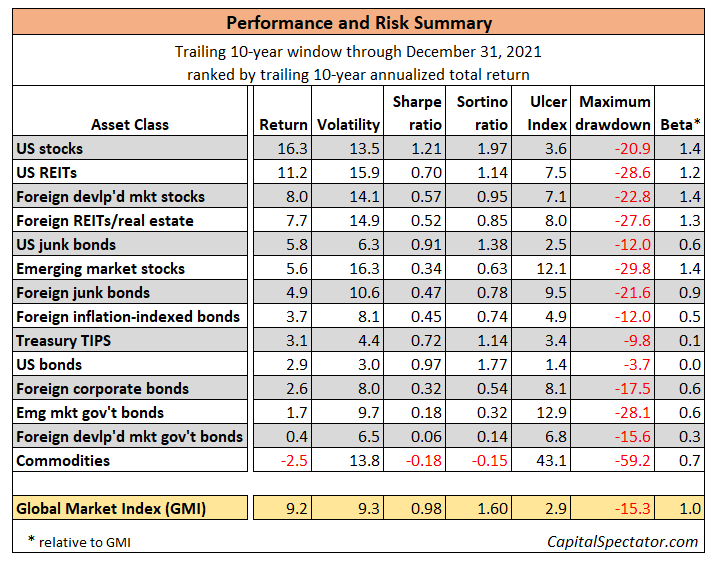

The table below presents additional risk metrics for GMI and its underlying asset classes, based on a trailing 10-year window through last month.

Here are brief definitions of each risk metric:

Volatility: annualized standard deviation of monthly return

Sharpe ratio: ratio of monthly returns/monthly volatility (risk-free rate is assumed to be zero)

Sortino ratio: excess performance of downside semivariance (assuming 0% threshold target)

Ulcer Index: duration of drawdowns by selecting negative return for each period below the previous peak or high water mark

Maximum Drawdown: the deepest peak-to-trough decline

Beta: measure of volatility relative to a benchmark (in this case GMI)

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno