* Fed begins shrinking its $8.9 trillion balance sheet to combat inflation

* OPEC agrees to boost oil output as Russian production drops

* China to launch aircraft carrier that will project military power globally

* US factory orders and shipments post modest gains for April

* Jobless claims eased last week, holding near multi-decade low

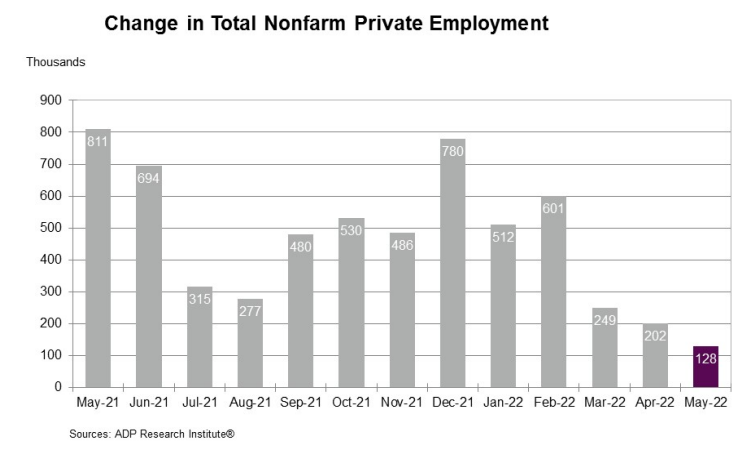

* ADP estimates hiring by US firms in May was the slowest gain of the recovery:

Deciding if a recession has started (or not) in the US will be unusually challenging in the months ahead. “It’s a very difficult time to interpret economic data and to even understand what’s happening with the economy,” says Michael Strain, an economist at the American Enterprise Institute, a center-right think-tank. “We’re entering a period where there’s going to be tons of debate over whether we are in a recession right now.”

US economic activity strengthens slightly in final week of May, based on New York Fed Weekly Economic Index:

Will the Fed put its rate-hiking policy on pause? Perhaps recent data showing softer US economic growth will convince the central bank to take a wait-and-see period for deciding if more hikes are needed? Don’t count on it, says Federal Reserve Vice Chair Lael Brainard. “Right now, it’s very hard to see the case for a pause. We’ve still got a lot of work to do to get inflation down to our 2% target.”

Is a 1970s-style energy crisis lurking? Fatih Birol, head of the International Energy Agency, an industry research group, thinks that’s a possibility. “Now we have an oil crisis, a gas crisis and an electricity crisis at the same time,” she says. “This energy crisis is much bigger than the oil crises of the 1970s and 1980s. And it will probably last longer.”

US consumer spending on goods peaked over a year ago but this isn’t a sign of an approaching recession, advises Neil Dutta, head of economics at Renaissance Macro Research. Rather, as people are outside the home more often as pandemic restrictions fade, their spending habits are change. “This does not mean that consumers are suddenly spending a great deal less overall. They’re just shifting where they spend,” he explains. “American consumers are picking up the pace across the service industries. They’re going out to restaurants, heading to the movies, and taking to the skies.” Bottom line: “Spending is shifting, not declining. And a shift in spending does not signal a recession.”