* US job openings remain high in April as companies struggle to find workers

* Saudi Arabia says it will pump more oil if Russia’s output falls sharply

* Biden reportedly will visit Saudi Arabia as oil prices stay high

* Mortgage rates in US up sharply after easing in recent weeks

* Fed Beige Book reports ‘slight or modest’ economic growth recently

* Global manufacturing output falls for second month in May via PMI data

* Construction spending in US rises less than expected in April

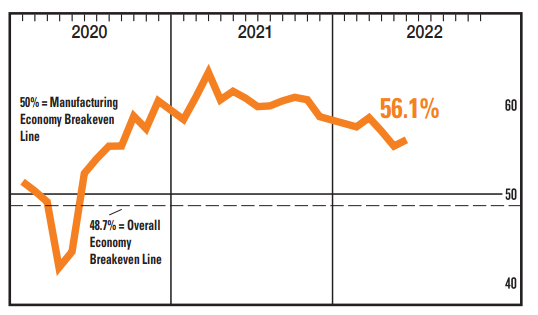

* US ISM Mfg Index rose in May, signaling that moderate growth continues:

St. Louis Fed President James Bullard recommends raising target rate to 3.5% to combat inflation. As the most-hawkish Fed official of late, he says “I think we have a good plan for now. This 50 basis point per meeting increase is twice the normal pace that the committee has used in recent years which shows that there’s a lot of unanimity around expeditiously moving to neutral in this high-inflation environment that we’re in.”

Will Europe’s ban on Russian oil launch a new world order for energy? “This will reshape not only commercial relationships but political and geopolitical ones as well.” The New York Times reports that “Europe’s hunt for new oil supplies — and Russia’s quest to find new buyers of its oil — will leave no part of the world untouched, energy experts said. But figuring out the impact on each country or business is difficult because leaders, energy executives and traders will respond in varying ways.” Robert McNally, an energy adviser to President George W. Bush, says Europe’s new policy of blocking Russian oil imports is a “historic, big deal” that “will reshape not only commercial relationships but political and geopolitical ones as well.”

Drawdown for S&P 500 Index at roughly -14% at Wednesday’s close (June 1), well above -20% mark that’s commonly cited as the tipping point for bear-market terrain. Nonetheless, Charles Schwab strategist Liz Ann Sonders says bear-market rallies are the new norm ‘for now’. She explains that “what we saw last week is what you tend to see in bear markets. Trading around them is certainly a possibility. I just think for shorter term investors, rallies look a little more ripe for trimming into then sell-offs look ripe for adding risk in portfolios.”