* US to provide Ukraine advanced rocket systems that may escalate the war

* China sends 30 warplanes near Taiwan during large training drill

* China eases Covid lockdown on Shanghai, the country’s economic and trade hub

* China mfg activity contraction eases in May, Caixin PMI shows

* Eurozone inflation rises to annual 8.1% pace in May, a new record high

* Chicago PMI rises in May, beating expectations

* Treasury Sec. Yellen concedes she was “wrong” about inflation expectations

* Is the US providing the Ukraine war with momentum that’s “impossible to stop”?

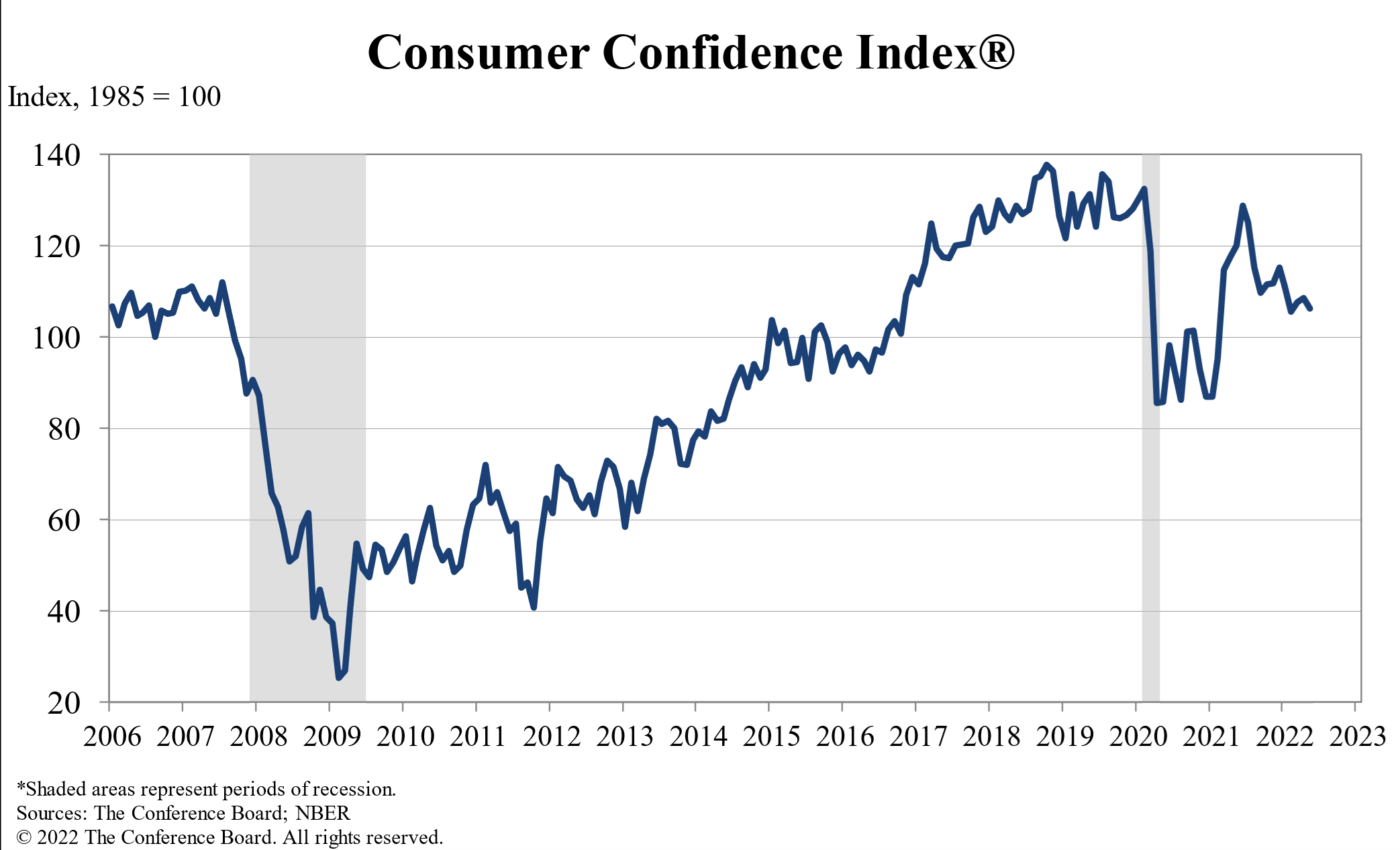

* High inflation and rising interest rates cool consumer confidence in May:

Goldman Sachs is rethinking recession risk for the US. “While our growth forecast has long been below consensus, we believe fears of declining economic activity this year will prove overblown unless new negative shocks materialize,” advises Goldman Sachs Chief Economist Jan Hatzius in a note to clients. He expects second quarter US GDP growth of 2.8%, a solid rebound from Q1’s 1.5% loss. GDP growth averaging 1.6% growth for the year ahead, with no recession, is his forecast. “Despite the market narrative of declining business activity and sharply lower management confidence,” Hatzius added, “the activity measures of the surveys available for April and May indicate a deceleration rather than a collapse.”

Americans’ economic pessimism falls to pandemic low via a Gallup survey. The results reflect polling for May 2-22. The survey was “conducted at a time of record-high gas prices, elevated inflation, government reports of declining economic growth in the first quarter, and a slumping stock market. Low unemployment is a rare bright spot, but employers are still struggling to find workers to fill needed jobs, which is contributing to ongoing supply chain problems.”

Regional Fed surveys still pointing to economic slowdown. The latest update comes from the Dallas Fed Manufacturing Survey, which “came in significantly lower than expected, with a reading of -7 versus the expected value of 1.5,” notes Prometheus Research. “The average of the regional surveys is now at zero, suggesting that we are at a tipping point for economic growth data.”