* US sends aircraft carrier group to eastern Mediterranean after attack on Israel

* Oil prices rise after Hamas attack on Israel

* OPEC raises long-term oil demand outlook

* Weighing the odds that Treasury yields will keep rising

* Private-credit firms are rapidly rising source of lending for corporate America

* Bank stocks under pressure from rising rates

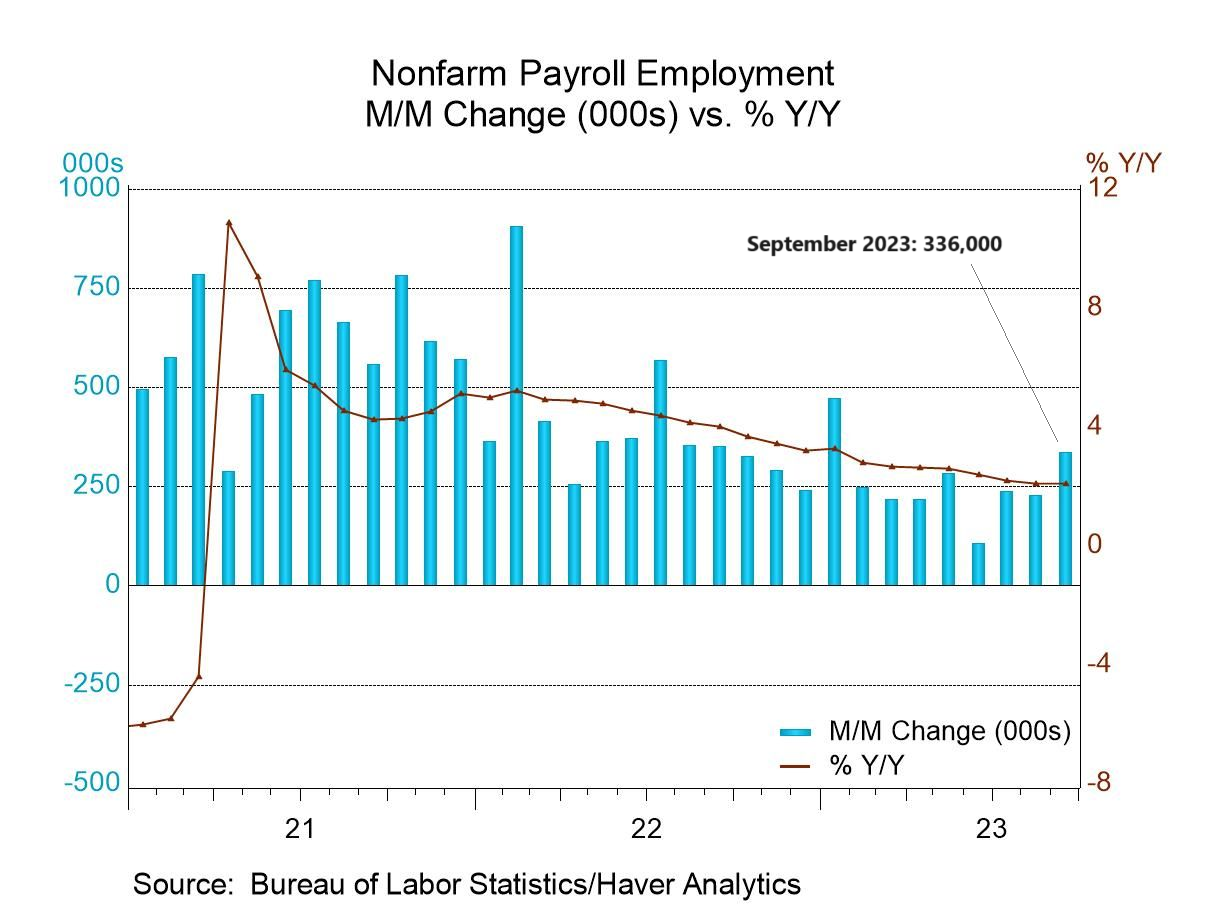

* Strong rise in September US payrolls will nudge Fed toward another rate hike:

Rising cost of borrowing for the US government suggests the Fed can’t keep rates elevated for too long. Will Matheson, co-founder of Matheson Capital, points out that the government financing problem has become increasingly challenging. “If debt is 100% of GDP, paying 4.5% interest means 4.5% of all GDP is going towards debt service,” he says. “Unfortunately, our debt is now 120% of GDP, so 4.5% interest means that 5.4% of all GDP has to go towards debt service.” Richard Gardner, CEO of Modulus, adds: “The national debt is not immune from interest rate increases, and, in fact, since 2020, the money spent on interest payments has almost doubled.”