* White House set to release deficit-cutting budget proposal

* Netherlands joins US in banning key microchip exports to China

* Markets cautiously await tomorrow’s payrolls report for February

* Markets see higher recession odds after Fed Chair Powell’s hawkish testimony

* Housing shortage persists in US by 6.5 million units, realty firm estimates

* China consumer inflation eases to slowest pace in a year in February

* Crypto bank Silvergate is shutting down, marking latest FTX aftershock

* US firms hire more workers than expected in February, ADP reports

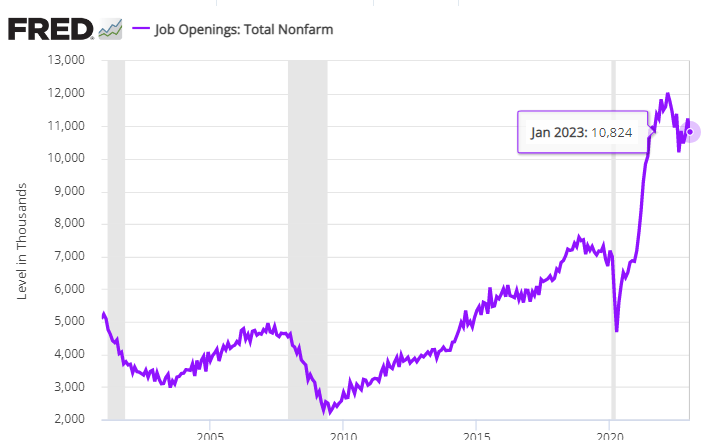

* US job openings eased in January, but remain elevated vs. history:

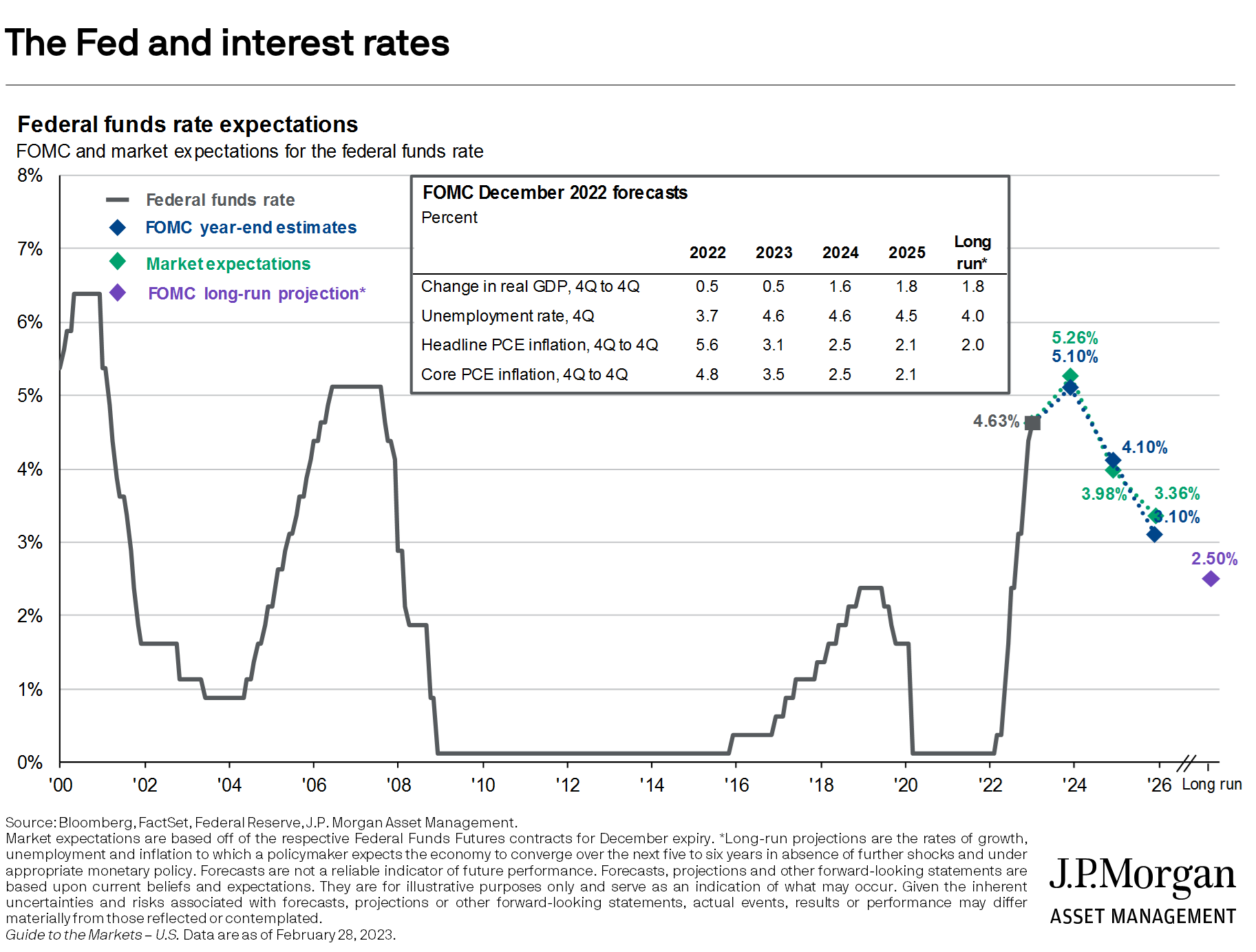

The Federal Reserve will raise its target rate to 6%–higher than recently expected, predicts BlackRock’s chief investment officer. “We think there’s a reasonable chance that the Fed will have to bring the Fed Funds rate to 6%, and then keep it there for an extended period to slow the economy and get inflation down to near 2%,” advises Rick Rieder. “This is partly due to the fact that today’s economy is no longer as interest-rate sensitive as that of past decades, and its resilience, while a virtue, does complicate matters for the Fed.” The forecast marks an upside change relative to the Fed’s expectations published in December, JP Morgan reports.

One of the “best” top-3 portable power stations: