The fall of Syria’s president over the weekend puts the nation on uncertain path and poses new risks for the Middle East and beyond. The overthrew of the government has resuffled the geostrategic chessboard on numerous fronts for Russia, Israel, Turkey and the US and other countries. “The Assad regime’s sudden collapse in Syria marks a profound and far-reaching geopolitical shift,” notes SpecialEurasia, a consultancy. “The rapid Syrian opposition military gains, spearheaded by Hayat Tahrir al-Sham (HTS), have significantly altered regional political and military conditions.” Qutaiba Idlbi, a senior fellow at the Atlantic Council advises: “The fall of the Assad regime presents an opportunity to address longstanding issues in Syria and the region. However, it is not a panacea and could lead to further instability if not carefully managed.”

US Consumer Sentiment rose for a 5th straight month in early December, according to polling by the University of Michigan. But in a possible sign of higher reflation risk: “Overall, year-ahead inflation expectations rose from 2.6% last month to 2.9% this month, the highest reading in six months but within the 2.3-3.0% range seen in the two years pre-pandemic,” notes a spokesperson for the survey.

China loosens stance on monetary policy to “moderately loose” from “prudent” for the first time in 14 years. “To escape the debt-deflation loop, Chinese policymakers need to ramp up fiscal measures to boost consumption,” note analysts at Brown Brothers Harriman. “As such, the latest politburo announcement is encouraging.”

President-elect Trump says he has no plans to remove Federal Reserve chairman Jerome Powell. Asked if would try to replace him, he responded: “No, I don’t think so. I don’t see it. But, I don’t — I think if I told him to, he would. But if I asked him to, he probably wouldn’t. But if I told him to, he would.”

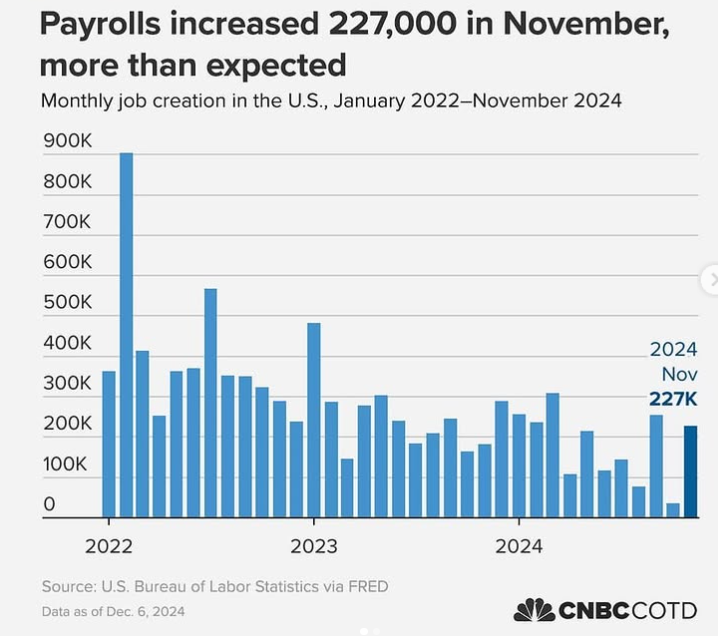

US payrolls rose 227,000 in November, well above expectations. The rise marks a solid rebound after October’s tepid increase, which was temporarily supressed due to hurriances and labor strikes. “Jobs creation may not be as robust as in the past years, but we are not seeing a disaster in the job market,” observes Bryon Anderson, head of fixed income at Laffer Tengler Investments.