* Banks report tighter lending standards

* IMF raises China GDP forecast for 2023 to +5.4%

* 20% of US offices vacant and WeWork bankruptcy won’t help

* If declining inflation continues, slide will be fastest in a century: Fed’s Goolsbee

* Why did so many economists fail to anticipate the recent disinflation?

* US crude oil prices fall below $78 a barrel–lowest since July

* US trade deficit deepened for first time in 3 months in September

* US credit card balances surged year over year in Q3:

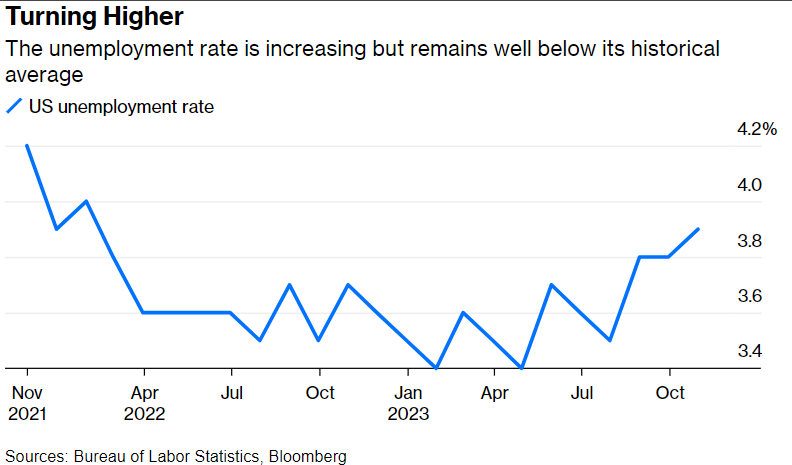

The Sahm rule, a reliable recession indicator based on changes in unemployment, is signaling that economic growth is still the likely path ahead. But the indicator’s creator — economist Claudia Sahm of Sahm Consulting and a former Fed economist — writes: “My Recession Rule Could Go Wrong This Time.” In a Bloomberg column she explains: “Relatively small increases in the unemployment rate, even starting from low levels, typically signal a recession. Where we are now is insufficient to make that call, but it’s worrisome.” She adds: “The Sahm rule is simple. If the three-month average of the unemployment rate (the monthly rate often bounces around too much) is half a percentage point or more above its low in the prior 12 months, the economy is in a recession. The current value is 0.33 percentage point, so it’s highly unlikely that we are in a recession – at least for now… Even so, the unemployment rate has risen, threatening to trigger a negative feedback loop of further unemployment that leads to a recession.” Sahm concludes that “a recession is not inevitable. Indicators of economic downturns like the Sahm rule are empirical regularities from the past, not laws of nature. The pandemic was extremely disruptive, and the rebalancing of the economy has been messy and slow.” As a result, “recession indicators based on the unemployment rate, like the Sahm rule, may not be as accurate this time.”