* Fed’s Powell says rate hikes may go higher than previously expected

* 2yr/10yr Treasury yield spread falls deeper into below-zero readings

* Workers across France protest pension reform proposal

* China announces shake-up of government oversight of financial system

* Eurozone GDP change revised down to zero for Q4

* US shale-oil boom appears close to peaking

* Buffett’s Berkshire Hathaway buys more Occidental Petroleum shares

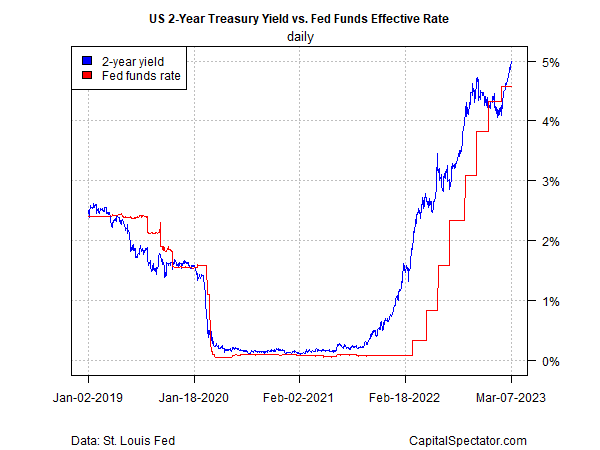

* US 2-year Treasury yield (proxy for rate expectations) rises to 5%, a 16-year high:

The 2-year US Treasury yield, a proxy for expectations for the Federal Reserve’s interest-rate target, rose to 5% yesterday after hawkish comments by Federal Reserve Chairman Jerome Powell. The rise in the 2-year rate is the market’s revised forecast that Fed funds will continue to rise well above the current 4.50%-4.75% range. “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell said in remarks prepared for appearances this week on Capitol Hill. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

One of the Highest Rated Water Bottles for 2023

YETI Rambler 26 oz. Bottle with Chug Cap