Business activity in the US services sector accelerated in December, according to the survey-based ISM Services Index. The index rose to 54.1, rising further above the neutral 50 mark, indicating a solid pace of expansion. A possible warning sign for inflation in the report is the strength in the prices index for services. “There was general optimism expressed across many industries, but tariff concerns elicited the most panelist comments,” says Steve Miller, chair of ISM’s Business Survey Committee.

US job openings rose for a second straight month in November, marking the first back-to-back increase in two years. The increases suggest that downside trend in job openings over the past two years may be stabilizing. But there’s also a worrisome trend that’s still unfolding via hires, which continued to slide, dropping close to the lowest level since pandemic.

Longshoremen are threatening to go on a strike that would shut down ports on the East and Gulf coasts. A strike could damage the American economy just as President-elect Donald Trump returns to the White House.

The US 10-year Treasury yield rose to its highest intraday level since April on Tuesday. The benchmark yeild at one point traded at 4.699%, just below its 52-week intraday high of 4.739% set in April. A factor drive the yield higher: economic news released yesterday point to so-called sticky inflation risk.

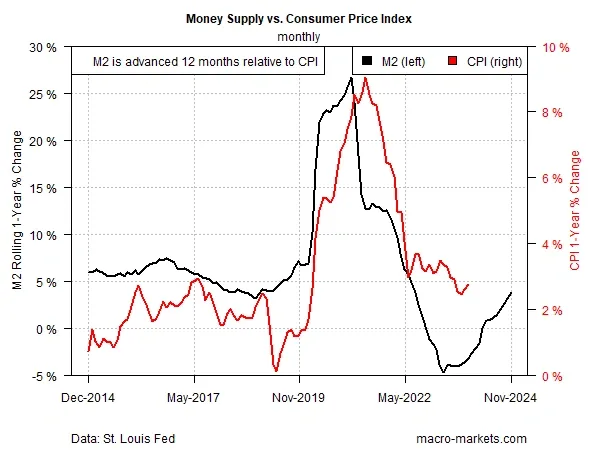

The ongoing rebound in the one-year growth rate of broad US money supply (M2) suggests that reflation risk persists, according to a research note from TMC Research, a division of The Milwaukee Co., a wealth management firm. “Year-over-year growth in US broad money supply continued to accelerate through November. The 3.7% annual pace marks the fastest pace in nearly 2-1/2 years… The rebound in money supply growth comes at a tricky moment for the Federal Reserve, which is attempting to navigate between two conflicting trends: slowing economic growth and sticky if not rising inflation.”