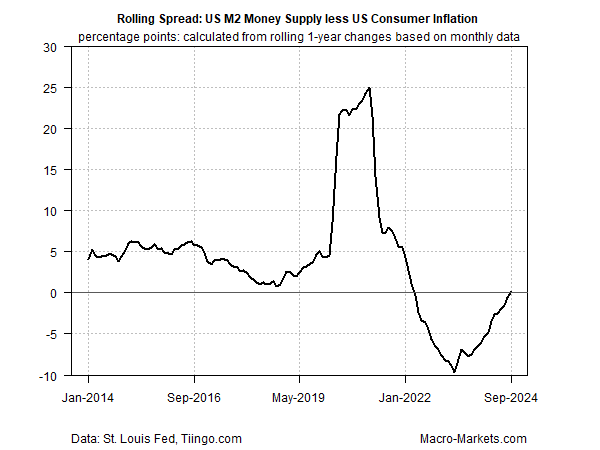

The Federal Reserve is expected to reduce its target rate today, but the wisdom of rate cuts is in doubt after Tuesday’s election. A research note from TMC Research advises that the central bank should pause rate cuts until the potentially inflationary consequences of Donald Trump’s policy plans become clearer. “Donald Trump’s election victory appears to have altered the assumptions about what’s prudent for monetary policy in the near term,” the report recommends. “Although the general outline of the president-elect’s agenda are well known, there’s debate about the details and, more importantly, how hard he’ll push on his policy positions re: taxes, tariffs, immigration and other macro topics. “Note, too, that broadly defined money supply (M2) in real terms is rising again after 2-1/2 years of contracting. The shift suggests that the policy bias is once more inflationary, albeit trivially so through September. But with the Fed poised to continue easing policy further, the central bank may find itself in an awkward position in next year’s first half if fiscal policy changes create a stronger tailwind for reflation.”

Eurozone economy remained mired in stagnation in October, based on survey data. Contraction of

of business activity in the currency bloc’s two largest economies – Germany and France – offset expansion elsewhere.

China exports surge in October, hitting a record high. “The better-than-expected export figures can be attributed to delayed shipments in October due to improved weather conditions, ongoing price discounts to capture market share, and the traditional peak season leading up to Christmas,” says Bruce Pang, chief economist of Greater China at JLL.

Global trade continued to contract in October, according survey data. The seasonally adjusted Global PMI New Export Orders Index ticked up to 48.9, marking the fifth straight month below the neutral 50 mark. The downturn in trade activity was due to weak activity in the goods producing sector.

US stocks surged on Wednesday following Trump’s election victory. Small-cap firms posted especially strong gains. The Russell 2000 index of small companies rose by a hefty 5.8%. “There is an expectation of economic policy pivoting inwardly for domestic growth, thus benefiting small-caps through broader growth,” says Michael O’Rourke, chief market strategist at JonesTrading.

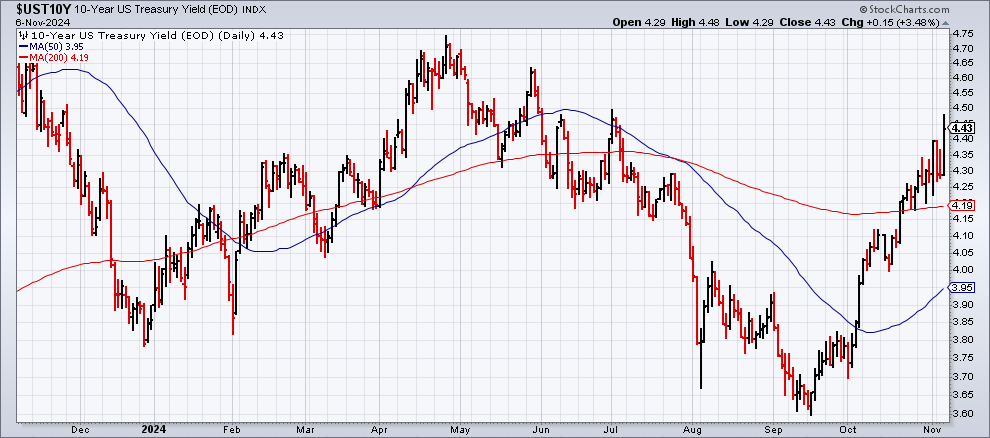

The US 10-year Treasury yield continued rising on Wednesday, moving up to 4.43%–a four-month high. One view is that a Trump presidency will unleash stronger inflationary pressures via tax cuts and higher tariffs on imports. Although that may lead to stronger economic activity, it could also lift inflation and deepen the government’s already hefty fiscal budget deficit.