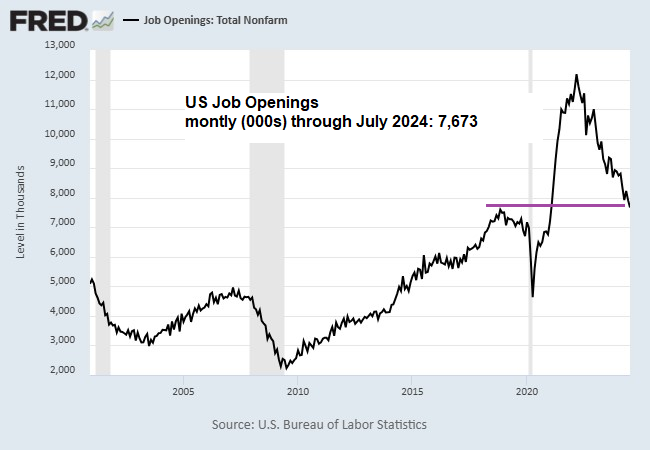

US job openings in July fell to the lowest level since January 2021, the Labor Department reports. The slide highlights concerns that the labor market’s recent slowdown will continue. The report also strengthens the view that the Federal Reserve will cut interest rates at next week’s policy meeting (Sep. 18). “The labor market is no longer cooling down to its pre-pandemic temperature, it’s dropped past it,” says Nick Bunker, head of economic research at the Indeed Hiring Lab. “Nobody, and certainly not policymakers at the Federal Reserve, should want the labor market to get any cooler at this point.”

US factory orders rebounded more than expected in July. Orders rose 5.0%, more than reversing a 3.3% decline in June, the Census Bureau reports. Economists forecast factory orders rebounding 4.7%, according to a Reuters poll.

The Fed’s Beige Book indicates softer economic conditions overall for the US. The report, an anecdotal summary for each of the central bank’s 12 districts, shows economic activity improved slightly in three districts vs. flat or declining activity in nine — up from five in the previous update.

Atlanta Fed President Bostic writes that the Federal Reserve needs to cut interest rates and shouldn’t wait until inflation returns to the central bank’s 2% target. “I believe we cannot wait until inflation has actually fallen all the way to 2 percent to begin removing restriction because that would risk labor market disruptions that could inflict unnecessary pain and suffering,” he advises. The Fed’s preferred inflation measure indicates a 2.5% inflation rate in July and 2.6% for the core rate (ex food and energy).

Fed funds futures are pricing in a modestly higher probability (57%) for a 1/4-point rate cut at the Sep. 18 FOMC meeting vs. a bigger reduction. A bigger cut could be destabilizing, predicts George Lagarias, chief economist at Forvis Mazars. “The 50 [basis point] cut might send a wrong message to markets and the economy. It might send a message of urgency and, you know, that could be a self-fulfilling prophecy. So, it would be very dangerous if they went there without a specific reason. Unless you have an event, something that troubles markets, there is no reason for panic.”

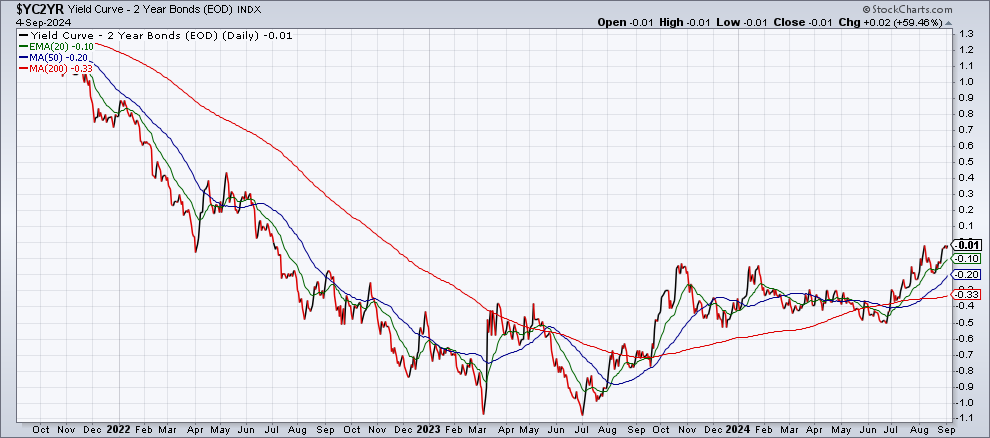

The widely followed 10-year/2-year Treasury yield spread briefly normalized yesterday (Sep. 4) after a long stretch of staying inverted (short rate above long rate). Some analysts see the flirtation with a normal spread as another sign that the Fed will adopt a dovish policy posture for the near term. “The Fed probably needs to move sooner and maybe even by 50” basis points, says John Fath, managing partner at BTG Pactual Asset Management US. “If they do, then the curve should disinvert completely.”