* Hard landing risk for US economy rising as Treasury yields increase

* Rise in interest rates creates bigger challenge for managing deficits

* A stock market crash may be the only savior for a falling bond market: Barclays

* Earth on track for hottest year on record, predicts European climate agency

* ISM Mfg Index edged lower in September but still reflects moderate growth

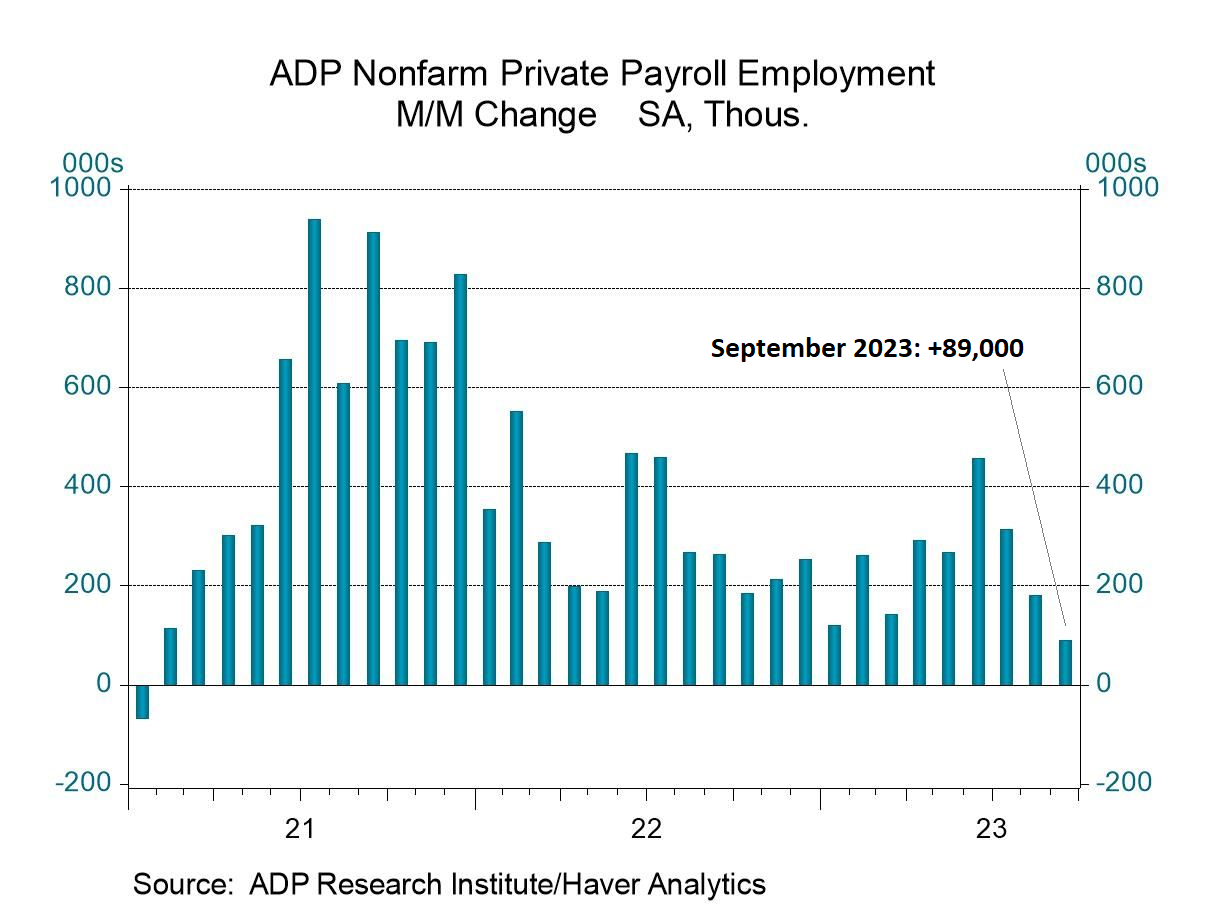

* US private employment growth slowed sharply in September via ADP data:

The recent rise in the 10-year US Treasury yield is partly (mostly?) attributed to the increase in the term premium, defined as “the compensation that investors require for bearing the risk that interest rates may change over the life of the bond.” The Economist reports: “The New York Fed publishes a daily estimate of the term premium on the ten-year Treasury yield, derived from a financial model. Since August it has risen by 0.7 percentage points, enough to fully explain the rise in bond yields over that time. Some attribute the surge in the term premium to simple supply and demand. The Treasury has been on a borrowing binge. From January to September alone it raised a whopping $1.7trn (7.5% of gdp) from markets, up by almost 80% on the same period in 2022, in part because tax revenues have fallen. At the same time, the Fed has been shrinking its portfolio of long-dated Treasuries, and some analysts think China’s central bank is doing the same. Traders talk of price-insensitive buyers leaving the market, and of those who remain being more attuned to risk.”

Some attribute the surge in the term premium to simple supply and demand. The Treasury has been on a borrowing binge. From January to September alone it raised a whopping $1.7trn (7.5% of gdp) from markets, up by almost 80% on the same period in 2022, in part because tax revenues have fallen. At the same time, the Fed has been shrinking its portfolio of long-dated Treasuries, and some analysts think China’s central bank is doing the same. Traders talk of price-insensitive buyers leaving the market, and of those who remain being more attuned to risk.”