* UAW reaches deal to end autoworkers strike

* China manufacturing sector contracts in October

* German economy shrank in the third quarter–a warning sign for Europe

* Eurozone inflation declines to 2-year low in October

* US commercial real-estate lending falling to historically low levels

* Manufacturing recovery in Texas continues in October, Dallas Fed reports

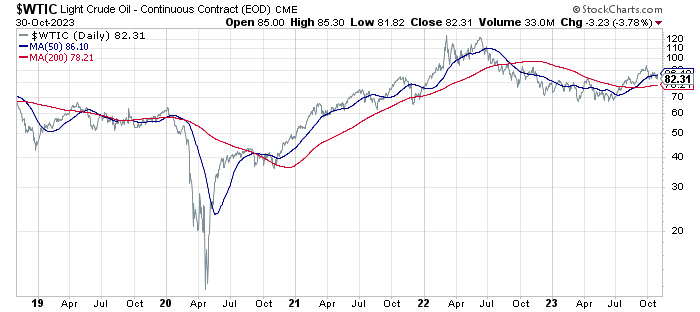

* Oil could soar to $150/bbl if Middle East conflict intensifies: World Bank

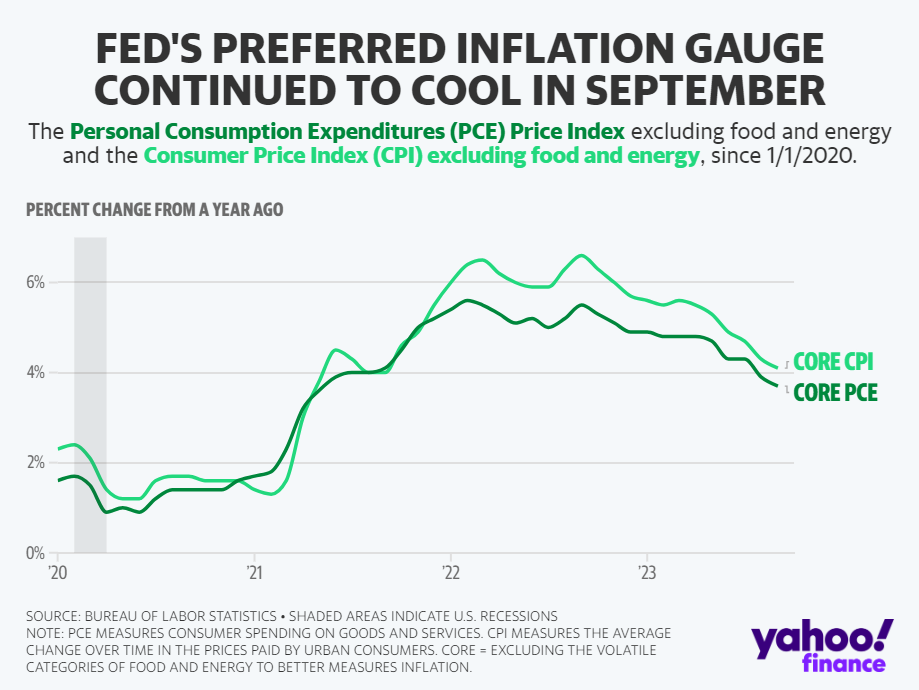

The Federal Reserve is expected to keep interest rates steady at Wednesday’s policy announcement (Nov. 1). Fed funds futures are pricing in a high level of confidence for no change in the Fed funds rate tomorrow. “The recent string of positive economic surprises will keep the Federal Reserve on high inflation alert, but it won’t tilt the Federal Open Market Committee toward another rate hike at the November meeting,” says EY chief economist Gregory Daco. “Still, Fed Chair Powell will undoubtedly want to maintain the optionality of a further rate hike in December or January, if needed.”