* S&P 500 profits get a boost from weaker US dollar

* Stock market rally showing signs of broadening as…

* Equal-weighted S&P 500 ETF (RSP) leads cap-weighted ETF (SPY) over past month

* US economy remains “resilient”, says Minneapolis Fed President Neel Kashkari

* 3 reasons why America may avoid a recession

* China’s factory activity for July contracts for the fourth straight month

* Eurozone growth picks up in Q2 and inflation eases

* Crude oil headed for biggest monthly price gain in more than a year

* Yellow, a major US trucking firm with 30,000 employees, is shutting down

* US consumer spending rose as inflation eased in June–‘sweet spot’ for economy:

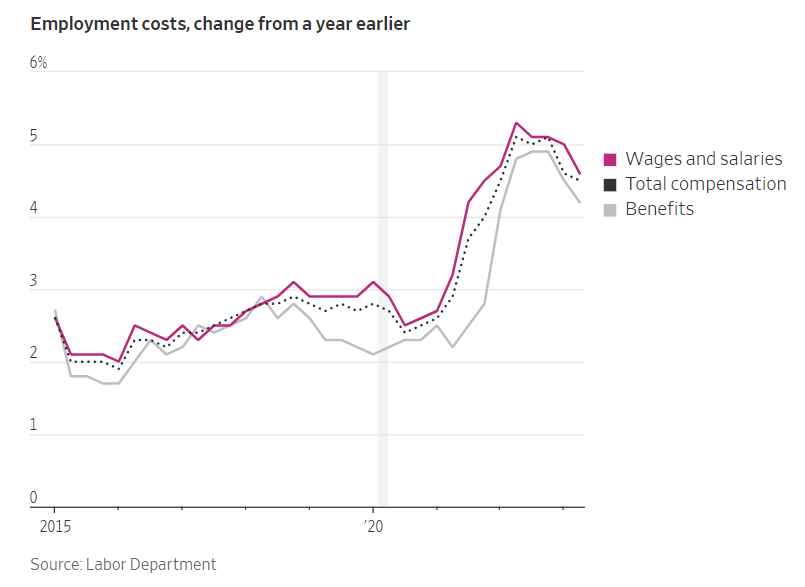

US wage growth continued to cool in the second quarter, providing deeper confidence that the recent and ongoing easing of inflation will continue. The Wall Street Journal reports: “Employers spent 4.5% more on wages and benefits in April to June from a year earlier, the Labor Department said Friday. That marked a slowing from a 4.8% increase the prior quarter. The employment-cost index, a measure of compensation growth closely watched by Fed officials, also posted its smallest quarterly increase in two years.”

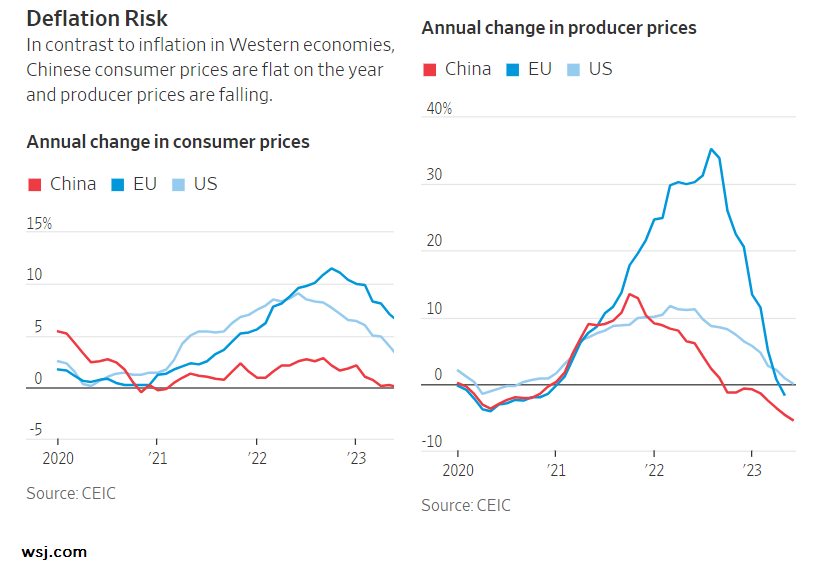

Deepening deflation/disinflation in China will weigh on global demand for commodities, including food, energy and raw materials. “The market is underestimating the deflationary impact on the global economy,” says Frederic Neumann, chief Asia economist at HSBC in Hong Kong.