Hiring at US companies rebounded in September, according to the ADP Employment Report. “Job creation showed a widespread rebound after a five-month slowdown,” notes ADP Research. “Only one sector, information, lost jobs. Manufacturing added jobs for the first time since April.”

A trifecta of economic risks are threatening to roil voter sentiment in the weeks leading up to the US election: a port strike, the aftershock Hurricane Helene and an escalation of fighting in the Middle East. Although the US economy remains strong, each of these factors could create turbulence that slows growth and affects voters’ decisions. “The last thing the supply chain, companies and employees … need is a strike or other disruptions,” business leaders wrote in a letter to the White House last week.

Is the port strike in the US that started this week the start of an era of heightened worker anxiety over automation? “Across the board, in very different sectors, we are seeing technology being rolled out in ways that can empower workers but it can also degrade their work or even displace them altogether,” says Alexander Hertel-Fernandez, an associate professor of international and public affairs at Columbia University and former US Department of Labor official.

Foreign investors weigh the prospects for China’s new stimulus package. The country’s stock market’s initial reaction is a surge in share prices, but it’s unclear if foreign investors will join the party. “Is this time different? We have seen these fits and starts where China puts in place some kind of stimulus and it has not resulted in a long-term constructive recovery,” says Saira Malik, chief investment officer of US asset manager Nuveen.

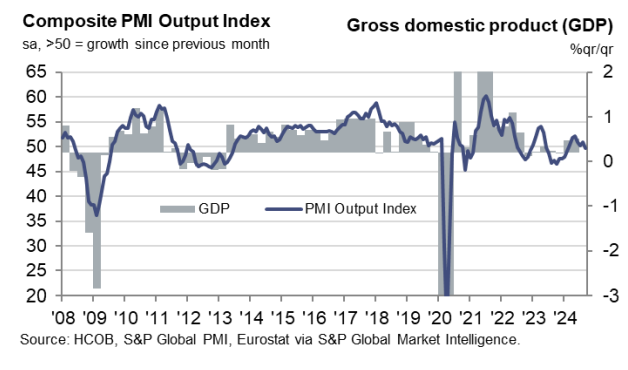

Eurozone economic activity contracted in September for the first time since February, according to PMI survey data. “Notably, the currency bloc’s big-three nations – Germany, France and Italy – recorded contractions simultaneously for the first time in 2024 so far,” S&P Global reports.