* OPEC leader: “resilient” demand and low investment could keep oil prices high

* United Auto Workers union reaches tentative deal on contract with Mack Trucks

* Office market headed for crash in US, investor survey says

* Office attendance in big cities still half of pre-pandemic level

* Construction spending in US increased for eighth straight month in August

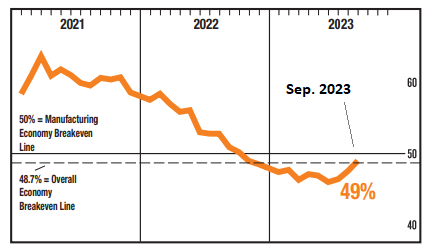

* US ISM Manufacturing Index edges higher again in September, close to neutral:

Federal Reserve Governor Michelle Bowman reaffirmed her view that another round of multiple interest-rate hikes may be needed to reduce inflation down to the central bank’s target. “I continue to expect that further rate increases will likely be needed to return inflation to 2% in a timely way. I see a continued risk that high energy prices could reverse some of the progress we have seen on inflation in recent months.” Meanwhile, the policy-sensitive US 2-year Treasury yield edged up yesterday (Oct. 2) to 5.12%, returning to last month’s peak — highest level since 2007.