* Federal Reserve expected to raise interest rates again at today’s policy meeting

* Rate hikes should be put on pause after this week, says former Fed vice chair

* Regional US bank shares drop sharply despite rescue of First Republic

* House Democrats unveil plan to force vote on lifting US debt limit

* Leaders of top AI companies to meet at White House today

* Gold price rebounds above $2000 an ounce

* US factory orders recovered in March, boosted by aircraft bookings

* US job openings fell again in March, contracting at a deeper annual rate:

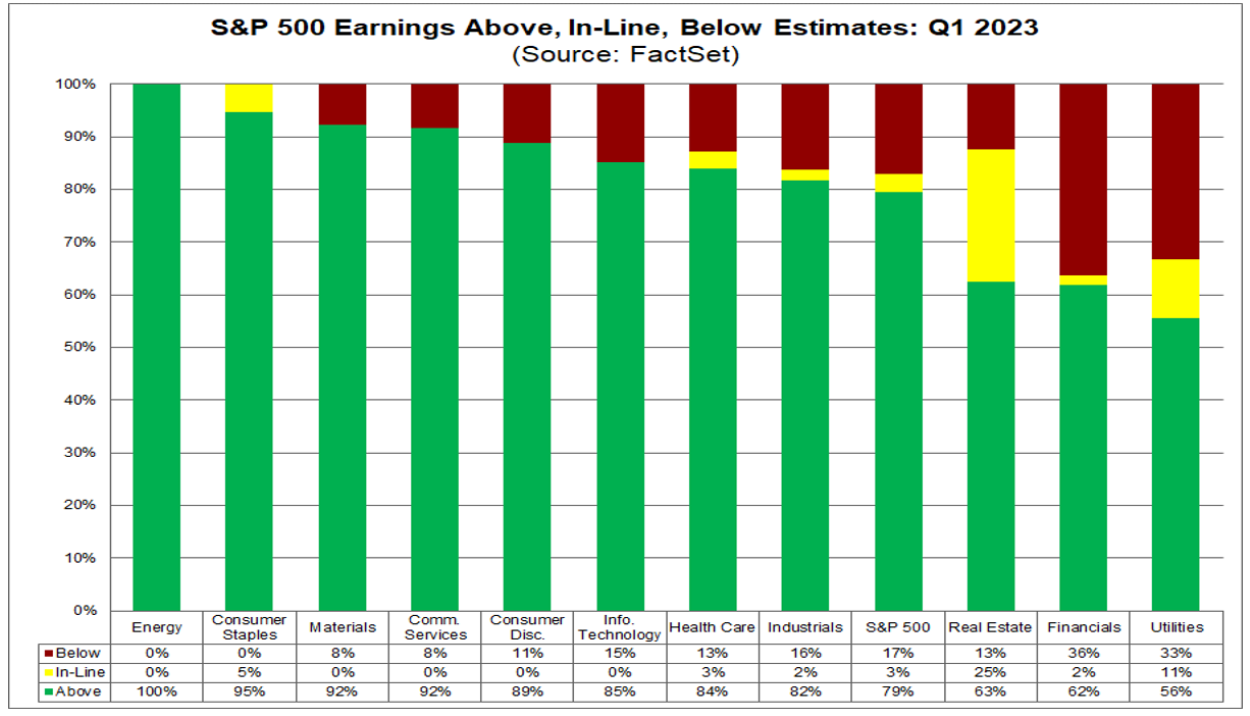

Companies in the S&P 500 are recording their “best performance relative to analyst expectations since Q4 2021” for Q1 earnings, reports FactSet. “Both the number of companies reporting positive [earnings per share] surprises and the magnitude of these earnings surprises are above their 10-year averages. The index is reporting higher earnings for the first quarter today relative to the end of last week and relative to the end of the quarter. However, the index is still reporting a year-over-year decline in earnings for the second straight quarter.”