* German Chancellor Olaf Scholz is meeting with Biden at White House on Friday

* Robust global economic data suggest central bankers need to raise rates further

* China business activity in services ‘rises sharply’ in February

* Eurozone business activity rebounds in February–fastest pace since June 2022

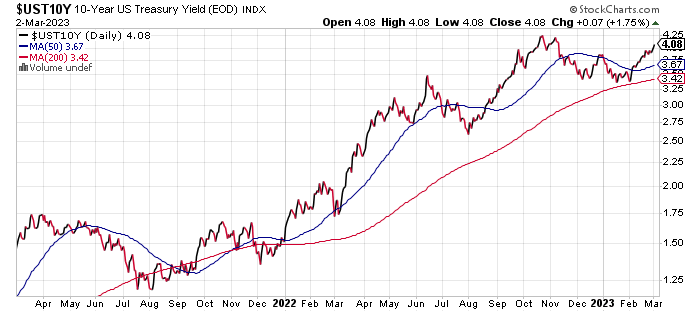

* Entire US Treasury yield curve now above 4%

* Average US 30-year mortgage rate rises above 7% again

* US jobless claims post downside surprise, highlighting labor market strength:

Fed governor Christopher Waller reaffirms that interest-rate hikes will need to rise further than recently expected if labor market and consumer spending data stays hot. “I would be very pleased if the data we receive on inflation and the labor market this month show signs of moderation, which would suggest that the February data releases were just a bump in the road and that progress is continuing,” he said in prepared remarks for a speech on March. “But wishful thinking is not a substitute for hard evidence, in the form of economic data. After seeing promising signs of progress, we cannot risk a revival of inflation. Policymakers must remain data dependent, so my view will depend on what the data say.”

US 10-year Treasury yield rose above 4% for first time since November–how much higher can it go? “We don’t believe the 10-year can stay over 4% for a long period of time without affecting the economy, and we expect to see an increase in unemployment as we move through the year,” says Rhys Williams, chief strategist at Spouting Rock Asset Management. “We wouldn’t get too negative on stocks and bonds, because we think both stocks and bonds will rally hard at the first sign that PCE inflation is slowing and unemployment is increasing, and we think that is likely in the next three months,” he tells MarketWatch.com.