US Consumer Confidence Index fell in January, but “has been moving sideways in a relatively stable, narrow range since 2022. January was no exception,” writes the chief economist at The Conference Board. “All five components of the Index deteriorated but consumers’ assessments of the present situation experienced the largest decline. Notably, views of current labor market conditions fell for the first time since September, while assessments of business conditions weakened for the second month in a row.”

US durable goods orders in December fell more than expected, primarily due to volatile transport orders. But orders for non-defense ex-aircraft, a proxy for business spending plans, rose for a second month, providing an upbeat spin on the data.

The rate of annual growth in US home prices accelerted in November, rising 3.8% for the year-ago level, up from 3.6% previously, according to the S&P CoreLogic Case-Shiller National Home Price NSA Index. The 10-City Composite saw an annual increase of 4.9%, recording the same annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.3%, up from a 4.2% increase in the previous month.

The Federal Reserve is expected to leave its target interest rate unchanged at today’s policy announcement, scheduled for 2:00 pm eastern. “The reason why the Fed isn’t jumping the gun at lowering the rates faster and further is that, on one hand, inflation is not gone,” says Erasmus Kersting, a professor of economics at Villanova University “They looked carefully at the data, and it is still stubbornly above target, so there is concern if you lower rates further, inflation would tick up again.”

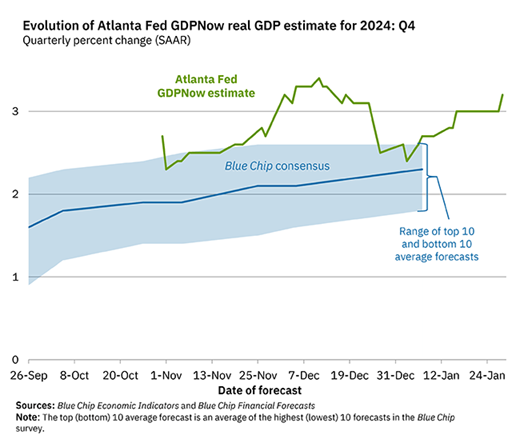

US fourth-quarter GDP growth was revised up to a strong 3.2% pace in the latest nowcast revision for the Atlanta Fed’s GDPNow model. The estimate reflects a slightly higher growth rate vs. Q3’s 3.1% increase.