* China in focus at wrap-up for G-7 meeting

* Larry Summers’ inflation warning was right. Now he sees secular stagnation

* Lagarde says ECB is ready to “move faster” on rate hikes if needed

* Strong dollar is especially worrisome for emerging markets this time

* US durable goods rose more than forecast in May:

Robust durable goods orders in May suggest the US economy may be more resilient than recently assumed. “There’s some inflation behind the increase in orders, but, nevertheless, there are a lot of dollars flowing through the economy right now,” says Christopher Rupkey, chief economist at FWDBONDS in New York. “Businesses would not order new equipment if they thought consumers and other companies were looking to pull back their purchases.”

Did the stock market reach its bear-market low last week? Unclear, but several key metrics that are worth watching on this front offer some modestly encouraging news, according to LPL Research. “Overall we have not seen the levels of market capitulation or fear to believe that all potential sellers have been flushed out, so it’s entirely possible for there to be another wave of selling after this bounce, but we have seen more of the market signals that typically occur around, or after, market lows.”

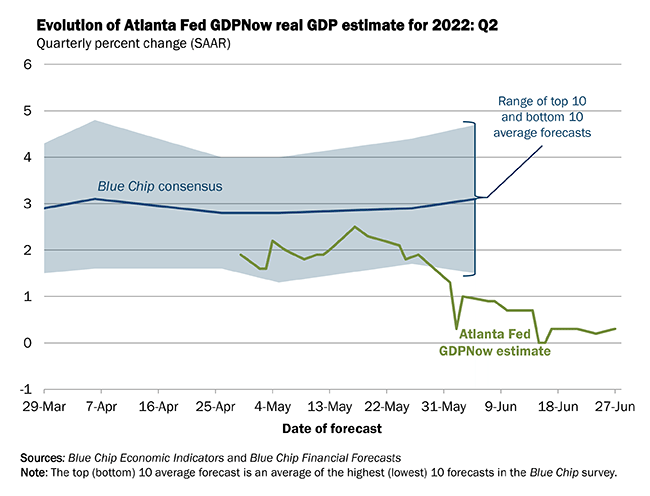

Atlanta Fed’s GDPNow estimate of US economic activity in Q2 ticks up to +0.3%. That’s still points to a virtually flat economy.