* US strikes targets in Syria in possible sign of widening Middle East conflict

* US government shutdown deadline on Nov. 17 is key test for new House speaker

* European Central Bank leaves rates unchanged after 10 straight hikes

* Pending home sales in US rose last month despite higher mortgage rates

* US jobless claims tick higher but remain ultra low

* Durable goods orders in US rise sharply in September

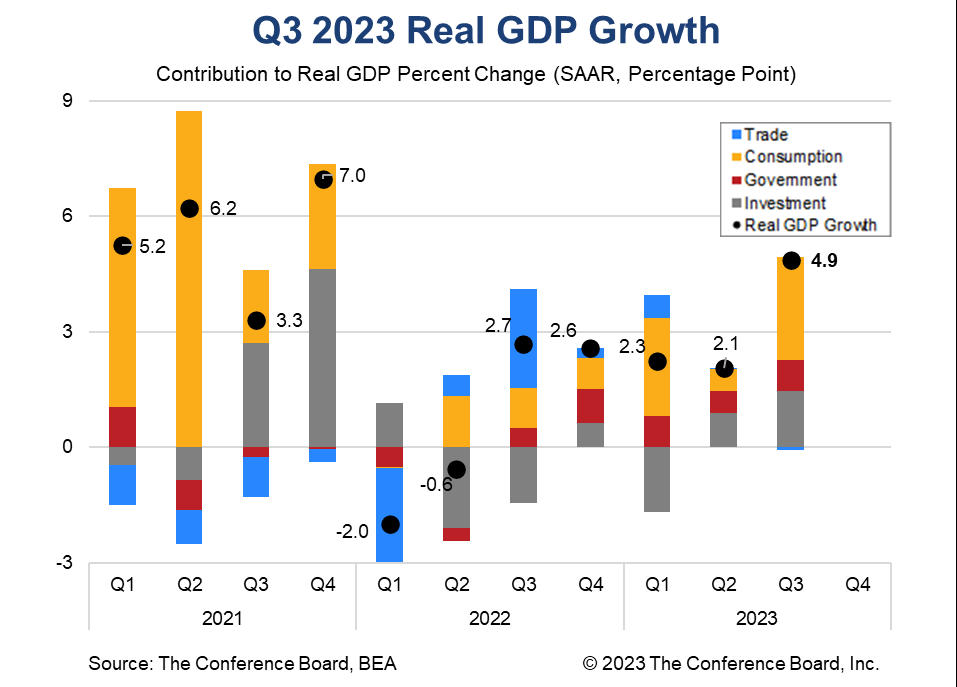

* US economic growth accelerates in Q3 to fastest pace since Q4:2021:

Rise in Treasury yields changes the calculus for stock-bond asset allocation decisions, analysts advise. “It isn’t as if we have never had 5, 5.5% — that was the norm. What is difficult for the market is that has not been the norm for many years,” Quincy Krosby, chief global strategist for LPL Financial, tells Reuters. “The market is having to adjust to a new calculus.” Earnings for S&P 500 companies are expected to rise 12.1% in 2024, predicts LSEG IBES. “If we have really prohibitively high interest rates, it is going to be hard to hit that target,” says Matthew Miskin, co-chief investment strategist at John Hancock Investment Management.