* Investors see rising odds of rate cut within four months

* Black Friday spending rises to record $9.8 billion, up 7.5% vs. last year

* Is the surge in money-market fund balances a bullish signal for markets?

* Another study reaffirms that buy-and-hold investing is tough to beat

* Are economists flying blind due to sliding response rates to official surveys?

* US economic activity remains weak in November via PMI survey data:

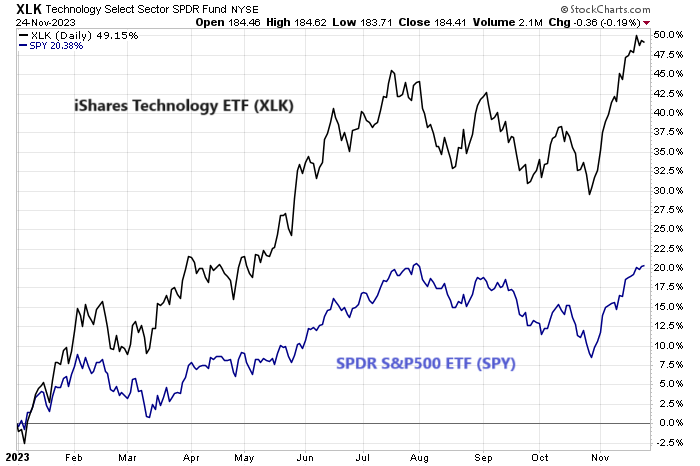

Mega-cap tech stocks have been the key driver of US equity gains this year and Goldman Sachs expects more of the same in the new year. “Our baseline forecast suggests that in 2024 the mega-cap tech stocks will continue to outperform the remainder of the S&P 500,” advises David Kostin, chief US equity strategist at the investment bank. “Analyst estimates show the mega-cap tech companies growing sales at a CAGR of 11% through 2025 compared with just 3% for the rest of the S&P 500. The net margins of the Magnificent 7 are twice the margins of the rest of the index, and consensus expects this gap will persist through 2025.”