* If China sends lethal aid to Russia, it would incur ‘real costs’, US warns

* Moldova worries it could be Russia’s next target for a Crimea-style annexation

* US Energy Dept says covid probably came from lab leak

* Will cyberattacks on Albania, a NATO country, trigger an alliance response?

* Even uber-investor Warren Buffett wasn’t immune from market losses in 2022

* US economic data is mixed, but economists still expect recession: NABE survey

* Policy-sensitive 2-year US Treasury yield breaks out to 16-year high:

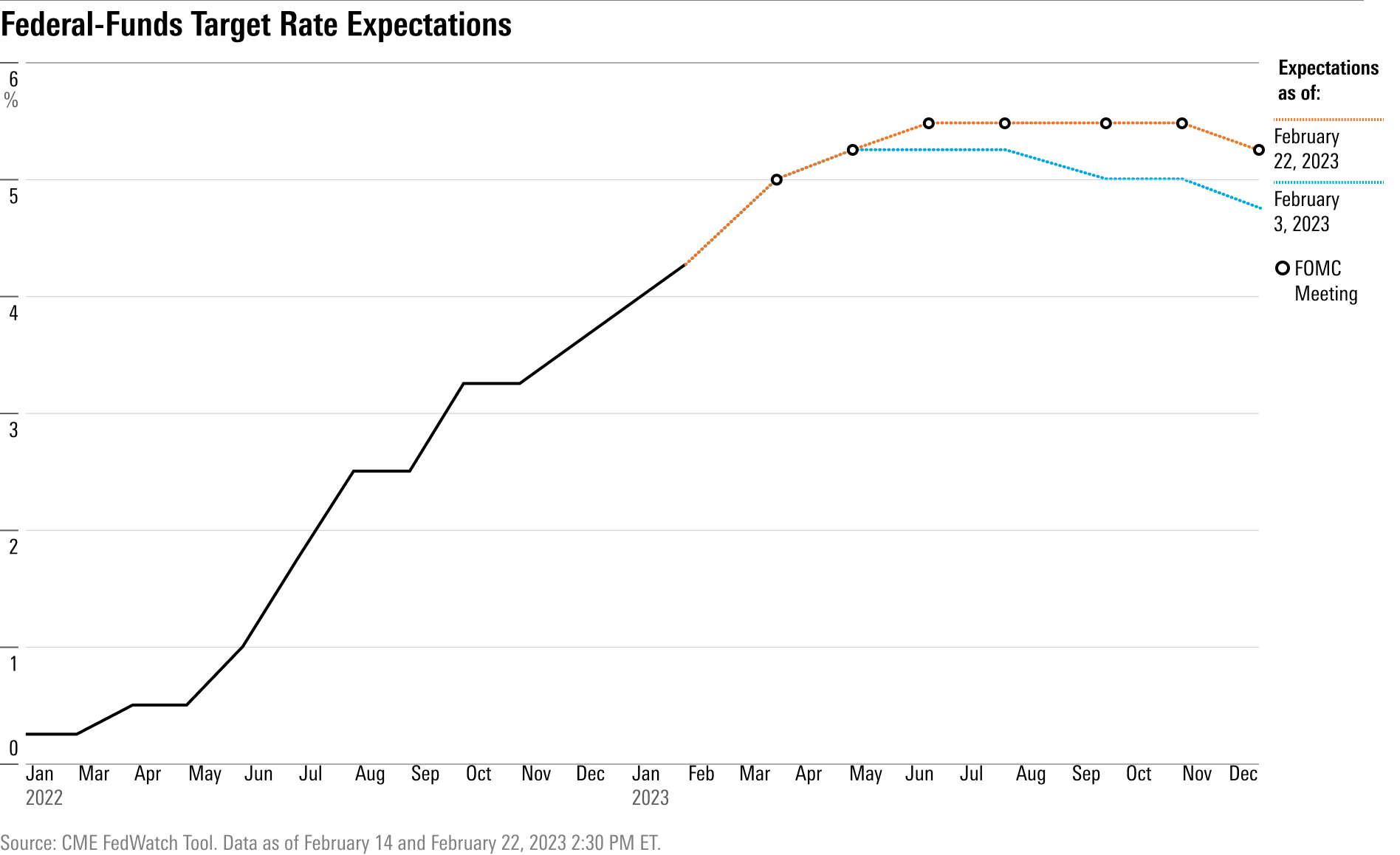

Markets are lifting expectations again for the peak level of interest rate hikes. “The terminal rate keeps getting pushed higher and higher,” says Al Bruno, associate portfolio manager for Morningstar Investment Management. “At the beginning of the year, the market was pricing in the Federal Reserve cutting interest rates by the end of the year, now that’s no longer the case.”

Supply chain blockages are easing, but related progress on cooling inflation pressure will be slow, analysts advise. “We need to be cautious about the drop in spot prices for containerized freight,” says Jason Miller, an associate professor of supply-chain management at Michigan State University. “Most freight moves under contract prices that are still well above pre-Covid levels.” Chris Rogers, head of supply-chain research at S&P Global Market Intelligence, adds: “Whilst the underlying prices have been coming down, it could take quite a long time for that to feed in. We’re still seeing some of the inflationary hangover coming through to product pricing now and it could take much of the rest of the year for that to flow through to prices, whether it’s producer or consumer.”