Congress passed a funding bill Wednesday to avert a government shutdown next week. If signed by President Biden, which is expected, the bill will fund the government through Dec. 20, setting up another spending fight just before the holidays.

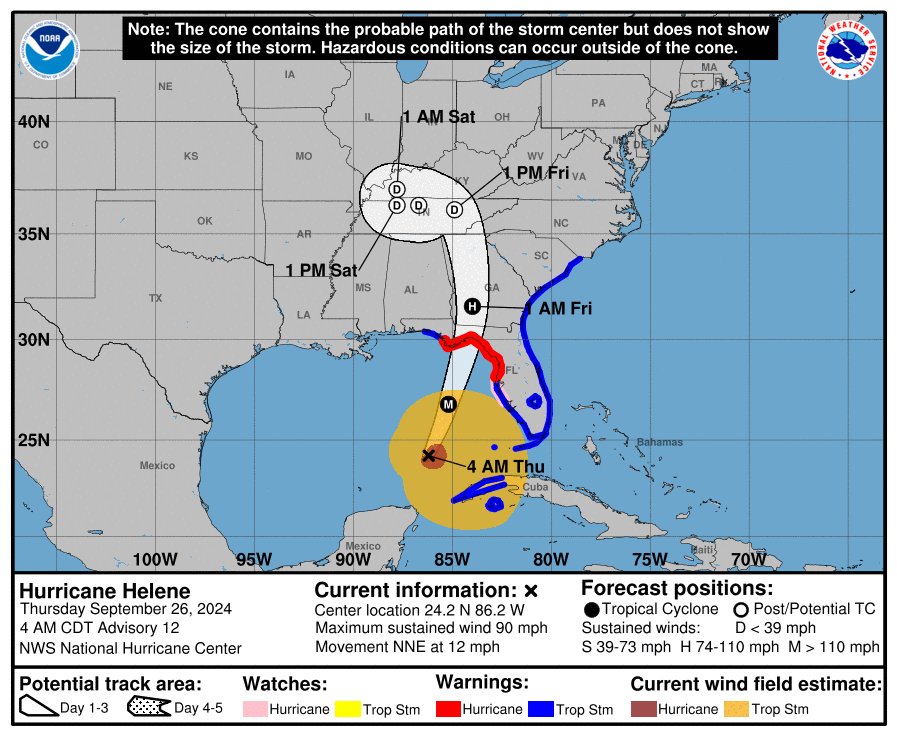

Florida’s upper west coast braces for Hurricane Helene for a Thursday evening or early Friday morning landfall. The National Weather Service warns: “A catastrophic and deadly storm surge is likely along portions of the Florida Big Bend coast, where inundation could reach as high as 20 feet above ground level, along with destructive waves.

New US home sales fell in August, but an upward trend off the late-2023 bottom still appears to be in progress. Presumably, the recent decline in mortgage rates, and the Fed’s decision to cut rates, will help keep the upward trend going in the months ahead.

Chipmaker Micron Technology’s stock surged on Thursday after the company projected higher-than-expected revenue for the upcoming quarter. Micron is the first chipmaker to report quarterly results this earnings season. “With the advent of AI, we are in the most exciting period that I have seen for memory and storage in my career,” CEO Sanjay Mehrotra said during a call on Wednesday.

New research suggests that AI can add value in predicting stock returns. In a review of recent research papers, Larry Swedroe, head of research for Buckingham Wealth Partners, reports: “The most important takeaway is that AI models help to avoid human bias, making forecasts more accurate—which should lead to markets becoming more efficient, reducing the opportunity to generate alpha through security selection.”

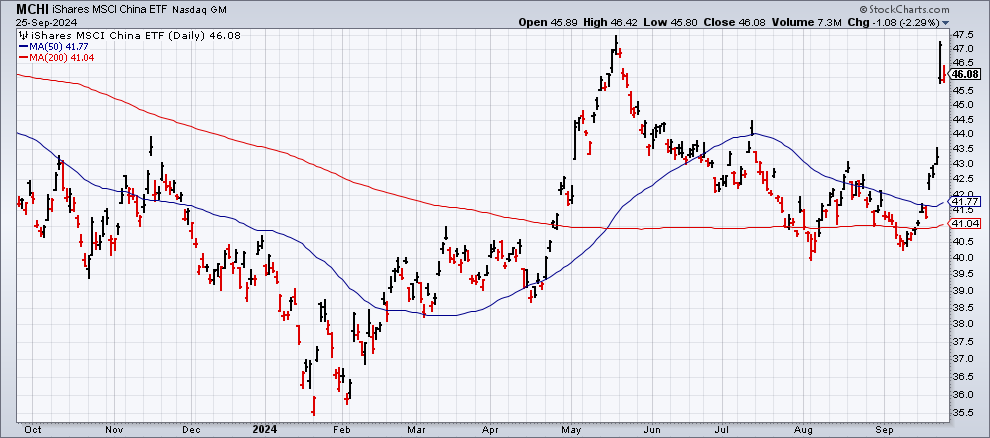

Will China’s recent stimulus packages revive China’s slowing economy? Some analysts have their doubts, Time reports. “This is a step in the right direction,” writes Julian Evans-Pritchard, head of China Economics at Capital Economics, in a research note. “But it will probably be insufficient to drive a turnaround in growth unless followed up with greater fiscal support.” Dinny McMahon, head of China markets research at Trivium China policy research group, notes: “This isn’t a stimulus package; it should be considered a relief package. None of this is going to get any institutions or economic actors in China to say, ‘let’s go invest now.’” China stocks, meanwhile, continue to trade well above recent levels, based on the iShares China ETF (MCHI) — an increase fueled by news of new programs to support the economy.