* World fossil fuel use projected to peak in 2030, IEA forecasts

* Autoworkers strike expands to plant that makes Ram 1500 trucks

* China stock market selling accelerates amid rising anxiety

* Despite upbeat data, Bill Gross still expects US recession by year end

* Rising geopolitical risks are buying opportunity for stocks: Jeremy Siegel

* Why is the US economy resilient? Paul Krugman looks for answers

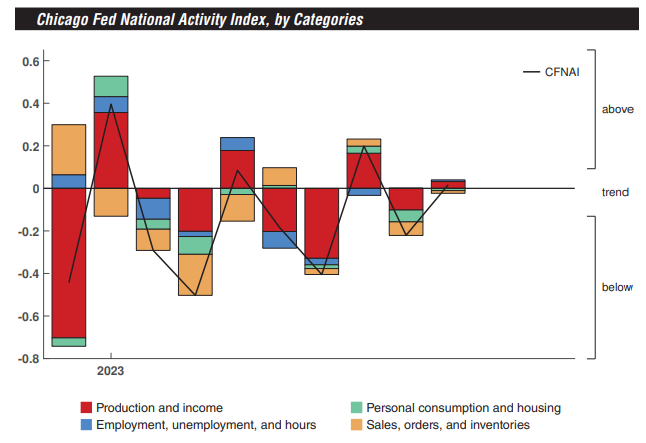

* US economic activity rebounded in September, posting above-trend growth:

Economists are still struggling to understand, much less forecast, the new economy regime that’s emerged from the pandemic. “The forecasts have been embarrassingly wrong, in the entire forecasting community,” Torsten Slok at Apollo Global Management tells The New York Times. “We are still trying to figure out how this new economy works.” Meanwhile, Thursday’s third-quarter GDP report is expected to post a strong acceleration in economic growth vs. Q2, according to Atlanta Fed’s GDPNow model (as of Oct. 18). If correct, the news will further diminish the validity of recent forecasts by some economists that US recession risk was rising.