* Eurozone economic activity edges back to growth in January via PMI survey data

* UK continues to post “sustained downturn” in January via PMI survey data

* US investment firms look to Europe for growth, start turning away from China

* Analysts expect US stocks will continue to underperform global peers

* The end of easy money is “particularly painful” for tech companies

* Microsoft will invest billions of dollars in OpenAI, creator of ChatGPT

* US Leading Economic Index fell sharply again in December:

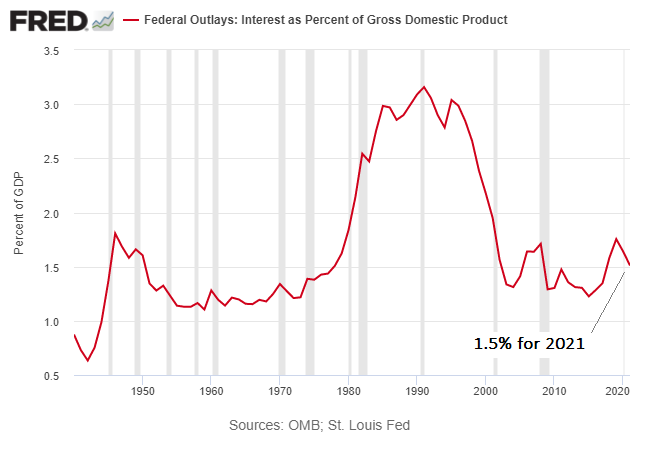

Claims that the US budget deficit is a severe risk for the country in the near term, and perhaps longer, are over-hyped, advises economist Paul Krugman. “It’s true that US debt is very large — $31 trillion (said in your best Dr. Evil voice). But America is a big country, so almost every economic number is very large. A better way to think about debt is to ask whether interest payments are a major burden on the budget. In 2011 these payments were 1.47 percent of gross domestic product — half what they had been in the mid-1990s. In 2021 they were 1.51 percent. This number will rise as existing debt is rolled over at higher interest rates, but real net interest — interest payments adjusted for inflation — is likely to remain below 1 percent of G.D.P for the next decade.”