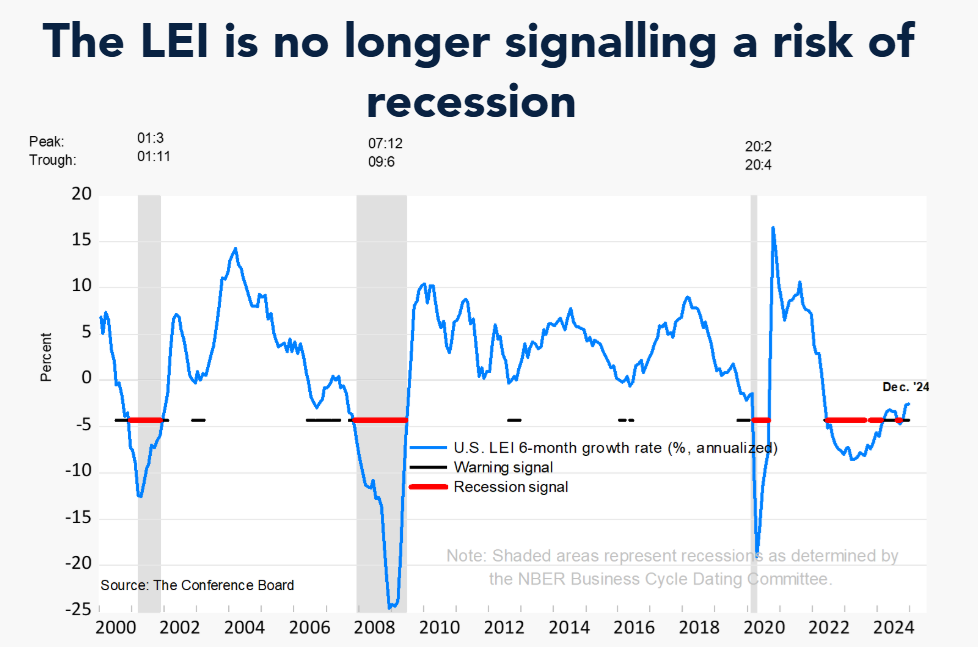

The US Leading Economic Index edged lower in December, but the 6- and 12-month growth rates “were less negative, signaling fewer headwinds to US economic activity ahead,” reports the Conference Board. “Nonetheless, we expect growth momentum to remain strong to start the year and US real GDP to expand by 2.3% in 2025.”

Business inflation expectations rose to 2.2% in January, according to the Atlanta Fed’s survey of firms’ year-ahead expectations. “Year-ahead unit cost expectations have fallen considerably since hitting a peak of 3.8% in April 2022 but remain somewhat elevated relative to their prepandemic average of 2.0%.”

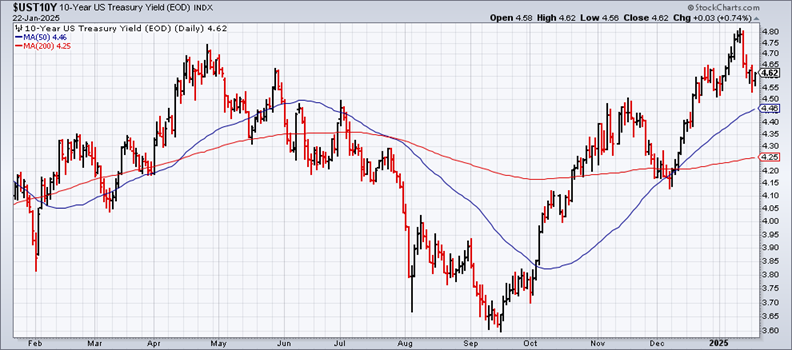

UBS global equity strategist Andrew Garthwaite advises that six of seven bubble conditions are flashing for the US stock market. MarketWatch reports: “Garthwaite says it’s time to worry if the 10-year Treasury yield exceeds 5%.” The 10-year rate is currently moderately below that assumed tipping point at 4.60% (Jan. 22).

Japan’s exports rose to a record high last year. Exports from the world’s third-largest economy increased to 107.9 trillion yen ($691 billion), above the 100 trillion yen mark for the second-straight year, and the biggest value on record for comparable data, which dates back to 1979.

More than half the American businesses (51%) operating in China are concerned about a further deterioration in the bilateral relationship between the world’s two largest economies, according to a survey published by the American Chamber of Commerce (AmCham). “A stable and constructive relationship, grounded in economic and trade ties, is critical not only for the prosperity of our two nations but also for global economic stability,” says AmCham China Chair Alvin Liu.

The US 10-year Treasury yield continues to trade moderately below recent peak of roughly 4.80%. The market is focused on incoming updates on “sticky” inflation and President Trump’s plans for tariffs, which some economists say will be inflationary.