* Stronger US growth requires higher rates, says former St. Louis Fed president

* ‘Higher-for-longer’ rate debate expected to dominate Fed’s Jackson Hole meeting

* Eurozone contraction deepens in August via Composite PMI survey data

* De-dollarization is in focus at BRICS summit, but it’s a ‘fantasy’ says analyst

* Richmond Fed Mfg Index indicates ‘sluggish’ activity continues in August

* US existing home sales fell again in July as prices rise from year-ago level:

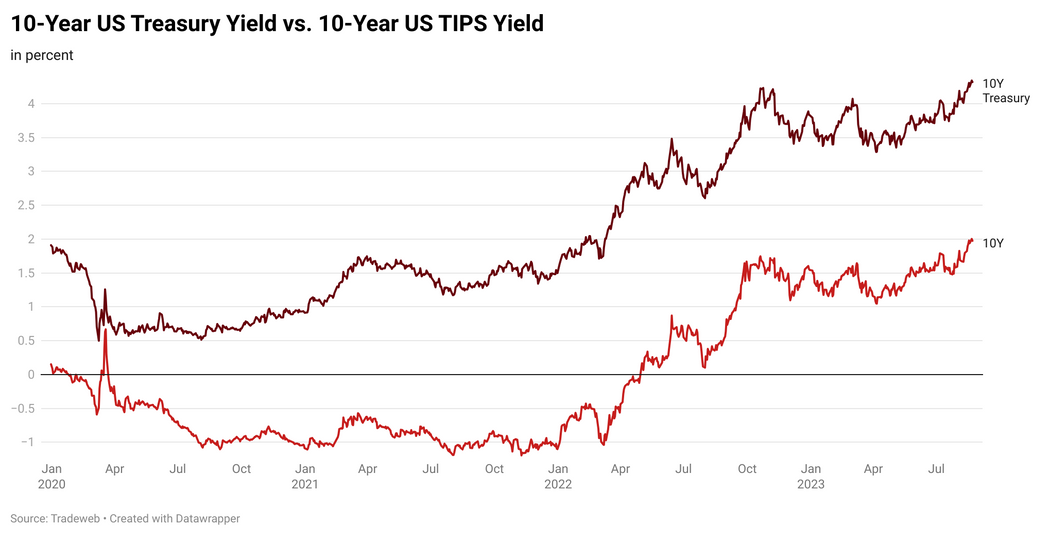

Higher US Treasury yields largely due to rising real (inflation-adjusted) yields, advises Joseph Kalish, chief global macro strategist at Ned Davis Research. “Bond yields have come a long way in a short period of time,” he writes in a research note this week. “Nearly all of the rise has been due to higher real yields.” An increase in the supply of US government debt is another factor. Kalish adds: “The market has been consistently underpricing the risk of additional rate hikes and overpricing the speed of rate cuts,” opining that Federal Reserve Chairman Powell will be “pleased at the progress on goods inflation, hopeful that the labor market is getting into better balance, but concerned about the economy growing faster than trend.”