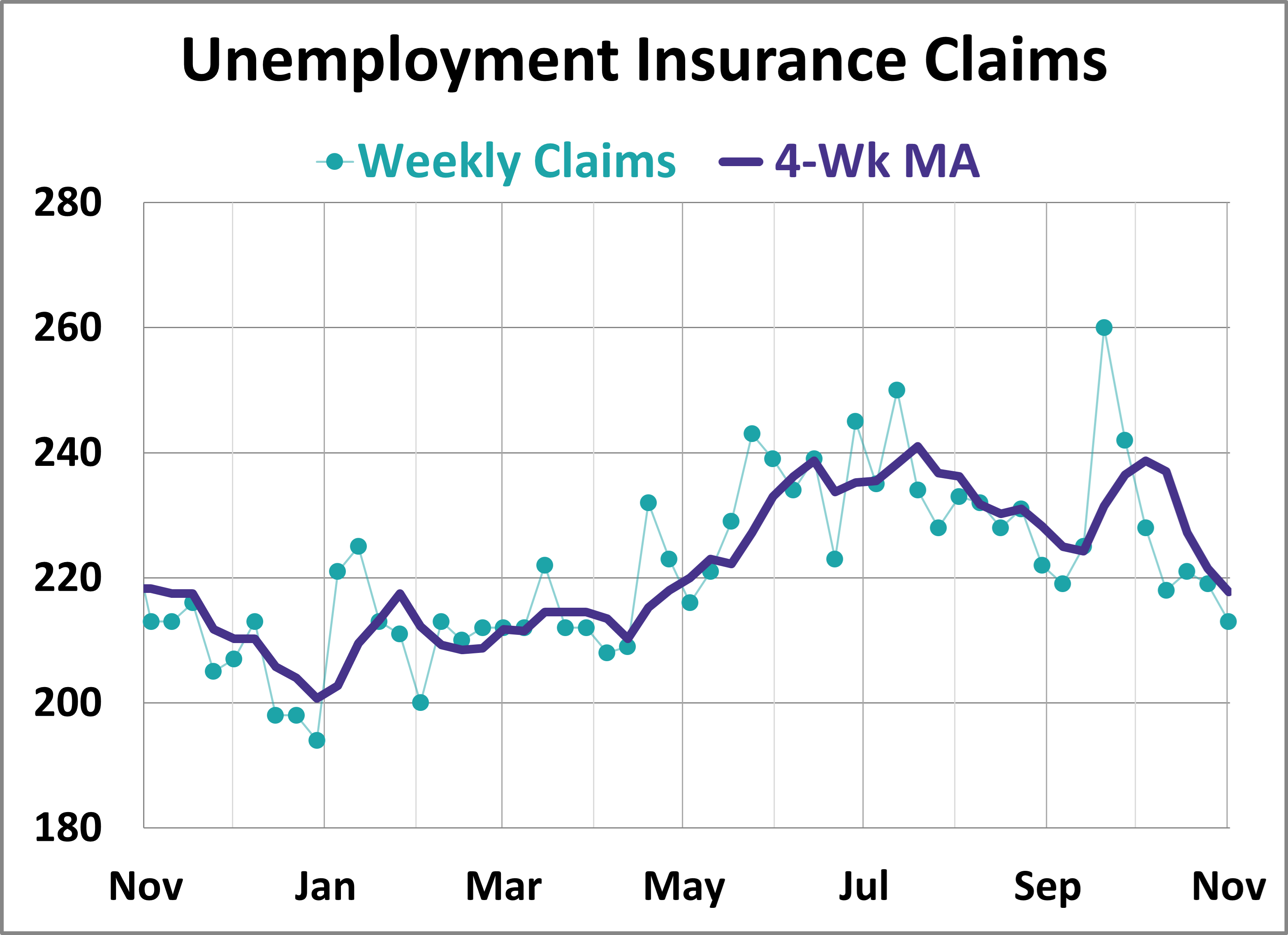

US jobless claims fall to the lowest level since April. “The weekly claims report remains the best real-time monitor of labor market conditions,” Jefferies US economist Thomas Simons writes in a research note. “Right now, the data show that the labor market is trending sideways at a healthy level.”

US existing home sales jump sharply in October. The gain marks the biggest monthly increase in nearly three years. Redfin reports there are “early signs that demand is increasing again now that the election is over.”

The Conference Board’s US Leading Economic Indicator continued falling in October. “The largest negative contributor to the LEI’s decline came from manufacturer new orders, which remained weak in 11 out of 14 industries,” says a spokesperson at the consultancy. But the ongoing slide in LEI is minimized for assessing the economy, some analysts note. “As long as [unemployment claims] remain low, layoffs are low, consumers are going to continue to do their thing. So you look at the LEI, you think the world is going to fall into pieces, you look at the [unemployment insurance] claims, you go, ‘Eh, no, that’s not happening,’” says Mark Zandi, chief economist at Moody’s Analytics.

Philly Fed Manufacturing Index unexpectedly falls in November, indicating contraction for the sector. “The survey’s indicator for current general activity turned negative, while the indexes for new orders and shipments declined but remained positive,” the bank reports. “The employment index turned positive, suggesting an increase in employment overall.”

Eurozone business activity moved back into contraction in November, according to PMI survey data. “The services sector took an unexpected dive, with activity dropping for the first time since January,” says Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

Investment performance for the clean energy industry diverges sharply this year, depending on the niche, advises a report from TMC Research: “Using the five-largest clean-energy ETFs as a guide, year-to-date performance results vary widely through November 20. Two of the five funds are outperforming a conventional fossil-fuels dominated ETF (XLE) while three are underperforming by wide margins.”