* Russia announces ‘partial mobilization’ of citizens in escalation of Ukraine war

* Federal Reserve expected to raise interest rates 75 basis points today

* US and Canadian warships sail through Taiwan Strait

* Germany nationalizes energy giant Uniper amid energy crisis

* Asia’s developing economies set to grow faster than China’s

* European businesses rethink plans for a ‘closed’ China

* Disinflation may return, predicts economist at Capital Economics

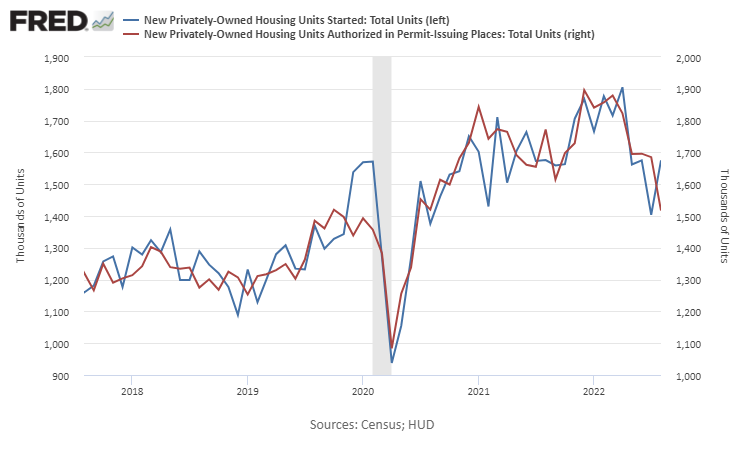

* US housing starts rebounded in August as new permits plunged:

Despite market corrections, expected returns for 60/40 stock/bond strategy benchmark remains low, advises AQR’s Cliff Asness. Although some observers may think markets are now cheap, “Unfortunately, they are not,” he writes. “Yes, markets are not as expensive as they were at the start of the year, but a few months of cheapening after a decade-plus of richening is a tiny drop in an awfully large bucket. We still live squarely in the world of low expected returns over the long term for most traditional investments.”

Oil prices continue to trend lower on bearish outlook for economic activity. “The market tone remained bearish due to concerns that the aggressive monetary tightening in the US and Europe would boost the likelihood of a recession and a slump in fuel demand,” says Toshitaka Tazawa, an analyst at Fujitomi Securities.