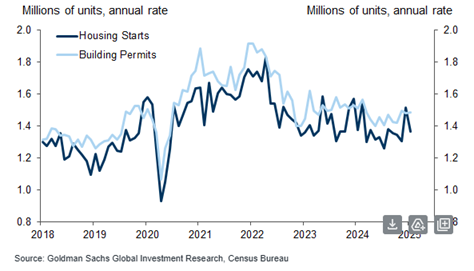

US housing starts fell more than expected in January, in part due to disruptions from snowstorms and freezing temperatures. “The outlook for more homebuilding is cloudy and gray as import tariffs are likely to push up building costs in the months to come, and homebuyers report the higher cost of borrowing is holding them back from being able to afford and purchase a new home,” says Christopher Rupkey, chief economist at FWDBONDS.

Fed minutes highlight inflation concern at the central bank’s latest policy meeting on Jan. 28-29. Fed officials expressed concern that President Donald Trump’s proposed tariffs and mass deportations of migrants, as well as strong consumer spending, could help push inflation higher.

Business inflation expectations are relatively stable at 2.3%, according to the Atlanta Fed’s latest survey. Firms’ year-ahead inflation expectations remained relatively unchanged, on average, at a pace modestly above the Fed’s 2% inflation target.

Gold continues to rally amid geopolitcal concerns. Bullion reached an all-time high of $2,955 an ounce on Wednesday.

China’s holdings of US Treasuries fell to their lowest level since 2009, according to US Treasury data. The report, however, does not include Treasuries owned by China in accounts outside the US. “China made a decision around 2010 that holding Treasuries was a risk, it looked bad optically that so much of China’s wealth was in the hands of a geopolitical rival,” says Brad Setser, a senior fellow at the Council on Foreign Relations and former US Treasury official.