* US 10-Year Treasury yield rises above 4% for first time since November

* Mortgage applications in US drop to 28-year low as rates rise

* Global manufacturing output rises in February after six months of decline

* Eurozone inflation eases in February but remains high at 8.5%

* Economists expect firmer economic growth in China for 2023

* US construction spending unexpectedly fell in January

* ISM Mfg Index ticks up in February but still shows sector contracting:

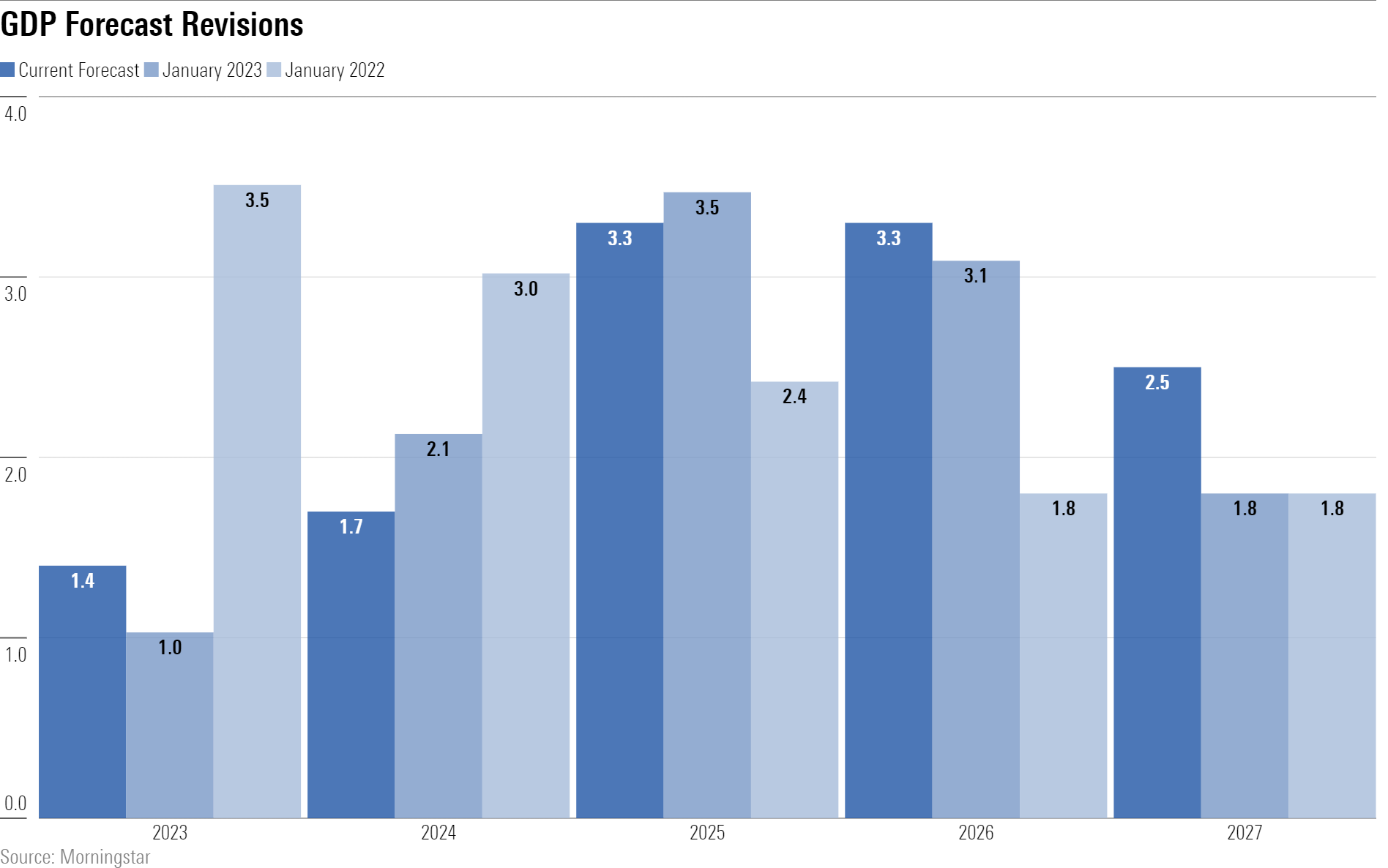

US growth will strengthen in 2023, predicts a a senior US economist for Morningstar Research Services. “Our outlook for the U.S. economy remains generally more optimistic than consensus, as we forecast stronger gross domestic product growth and lower inflation. We place the probability of recession risk at just 25% for the next two years,” writes Preston Caldwell. “With inflation already easing substantially without a recession, we’re very confident that the U.S. economy is capable of a soft landing, but achieving it is contingent on avoiding monetary policy error.”

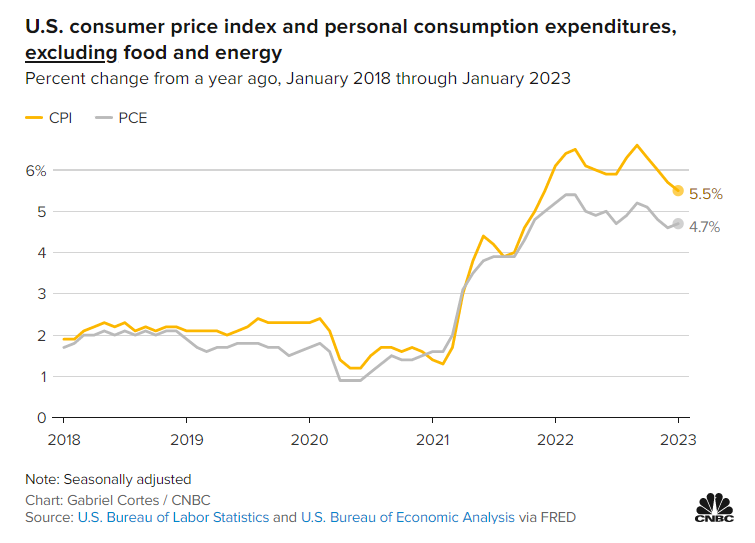

Fed’s inflation fight still has a long way to go, advises Quincy Krosby, chief global strategist for LPL Financial. “It took them a long time to acknowledge that inflation was stickier than they initially assessed,” she tells CNBC. “They have a ways to go.” Steven Blitz, chief US economist at TS Lombard, adds: “They slowed [the pace of hikes] prematurely. We’re just at the starting gate of their policy moves biting.”