* US Treasury’s “extraordinary measures” start today for paying government’s bills

* US producer price inflation cooled in December

* Job cuts in tech industry spread as Microsoft plans to lay off 10,000 workers

* Fed chairman Jerome Powell tests positive for coronavirus

* Cryptocurrency firm Genesis Global Capital set to file for bankruptcy

* Global bond sales surge to record start in 2023: nearly $600 Billion

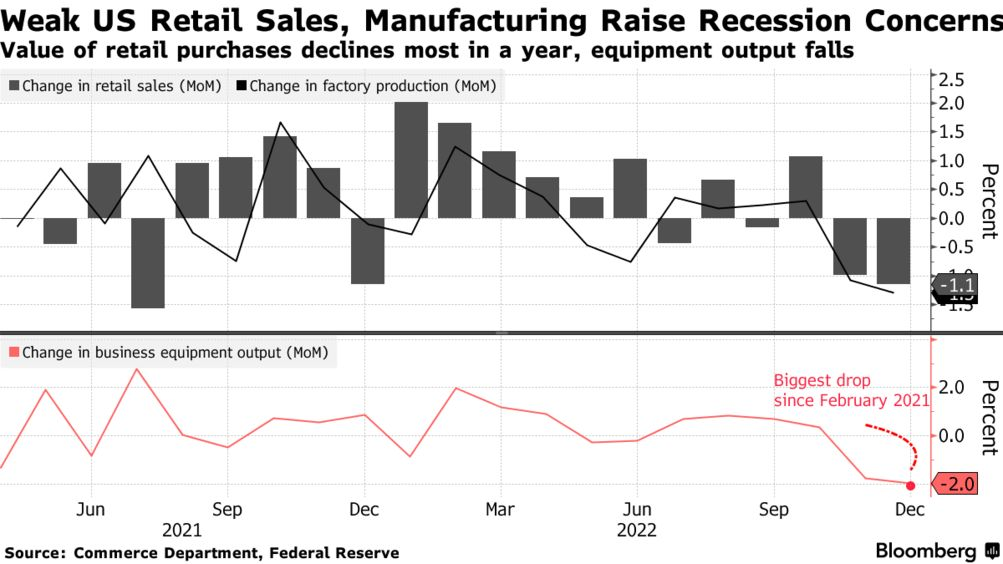

* US industrial output falls more than expected in December

* Fed’s Beige Book: inflation slowing while job market remains tight

* Home builder sentiment rises in January–first monthly gain in a year

* US retail sales decline for second month in December:

Some Fed policymakers say more rate hikes needed to tame inflation. “I just think we need to keep going, and we’ll discuss at the meeting how much to do,” says Cleveland Fed President Loretta Mester. St. Louis Fed President James Bullard also wants rates to rise further, recommending that the Fed funds target rate — currently at 4.25%-4.50% range — go above 5% “as quickly as we can.”