* Red Sea attacks threaten global supply-chain disruption

* Is the appetite for rising US debt near a limit?

* Overtightening risk suggests rate cuts needed, says Fed official

* Poll finds renewed demand for stocks fueled by expectations for rate cuts

* Bank of Japan maintains ultra-easy policy amid ‘extremely high’ uncertainties

* Goldman Sachs lifts S&P 500 forecast on high confidence for rate cuts

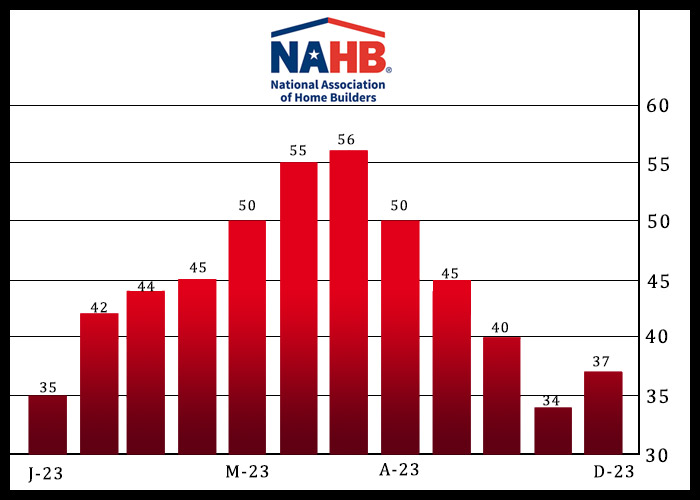

* US home builder sentiment rises in December for first time in 5 months:

A soft landing for the US economy has been “achieved,” writes economist Paul Krugman. “How did we pull that off? The answer seems fairly clear. Economists who argued that the inflation surge of 2021-22 was ‘transitory,’ driven by disruptions caused by the Covid pandemic and Russia’s invasion of Ukraine, appear to have been right — but those disruptions were bigger and longer lasting than almost anyone realized, so ‘transitory’ ended up meaning years rather than months. What happened in 2023 was that the economy finally worked out its postpandemic kinks, with, for example, supply chain issues and the mismatch between job openings and unemployed workers getting resolved.”