* US Leading Economic Index falls for fifth straight month

* US jobless claims edged lower last week, continue to reflect low level of layoffs

* Philly Fed Manufacturing Index rebounded in August

* Norway and New Zealand’s central banks announce latest rate hikes

* Turkey’s central bank cuts interest rates despite surging inflation

* Extreme heat strikes world’s three largest economies simultaneously

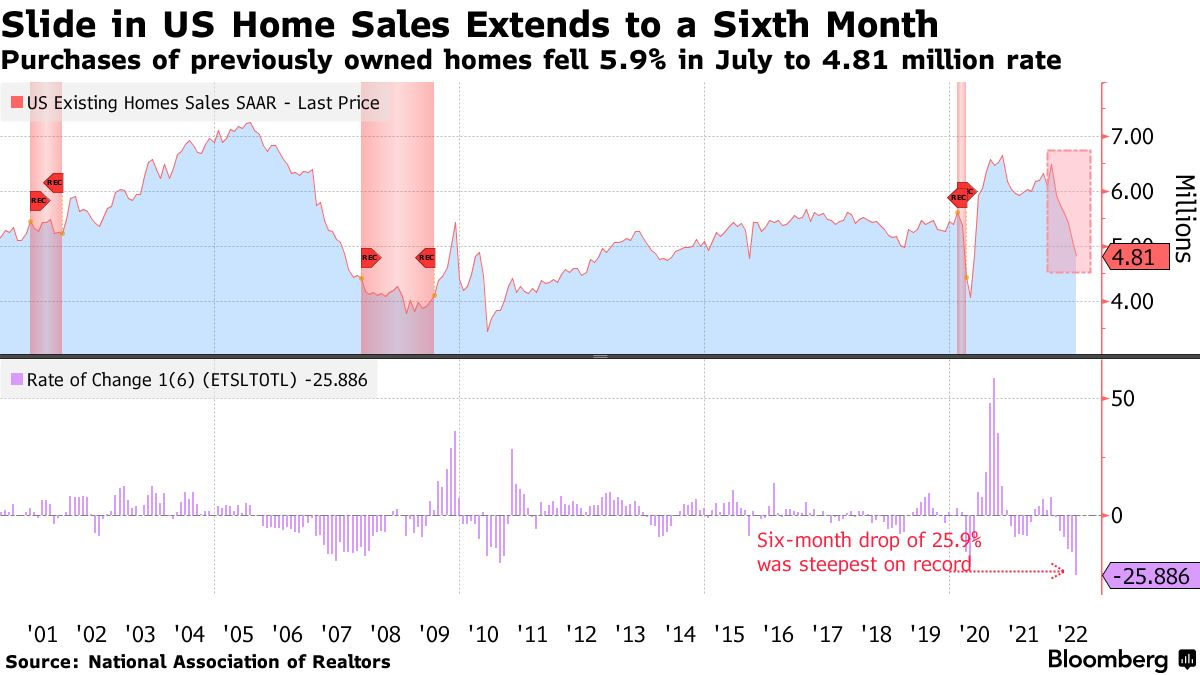

* US existing home sales fell for sixth straight month in July:

Lower mortgage rates may be sign that inflation has peaked. The average US 30-year fixed-rate mortgage ticked down to 5.13% for the week through August 18. That’s still well above the rate from a year ago, although Sam Khater, Freddie Mac’s chief economist, says “Inflation appears to be beyond its peak, which has stopped the rapid increase in mortgage rates that the housing market was experiencing earlier this year.”

San Francisco Fed president says raising interest rates by 50 or 75 basis points at the Sep. 21 FOMC meeting would be a “reasonable” way to help tame inflation. Although the central bank has already lifted rates several times this year, “We have a lot of work to do at the Fed to bring us back to price stability,” says Mary Daly. “The job market is strong, inflation is too high.”

Former Pimco chief economist, Paul McCulley, sees a “soft landing” ahead for the US economy: